Last week we were on the high seas, this week we’re sticking with the water theme. We’ll be exploring water rights.

Let’s dive in!* 👇

*This phrase is overused, but it makes sense here, so I’ll let it slide.

Table of Contents

The planet’s freshwater is declining

When we talk about precious commodities, most people think of stuff like gold, cotton, soybeans, and crude oil. But the most precious commodity of all is the one we all take for granted.

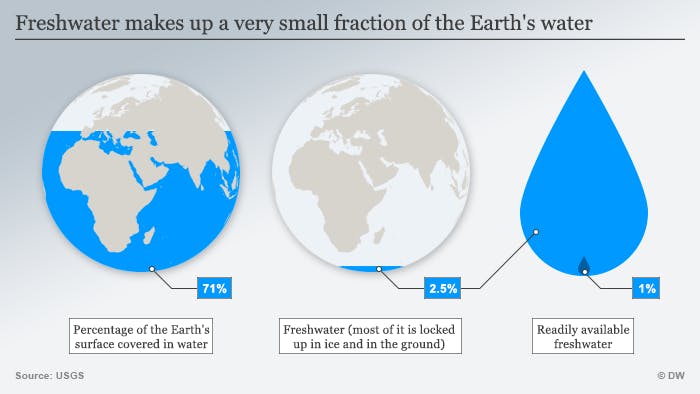

The reason is that people falsely believe there is more water available than there actually is. Yes, the Earth is 71% water, but only 3% of it is drinkable. And the majority of that is located within glaciers or in deep underground caverns.

Much of this underground water is at risk. According to a NASA study, many freshwater sources are being used up faster than they’re being replenished. 21 out of the world’s 37 largest aquifers are officially receding.

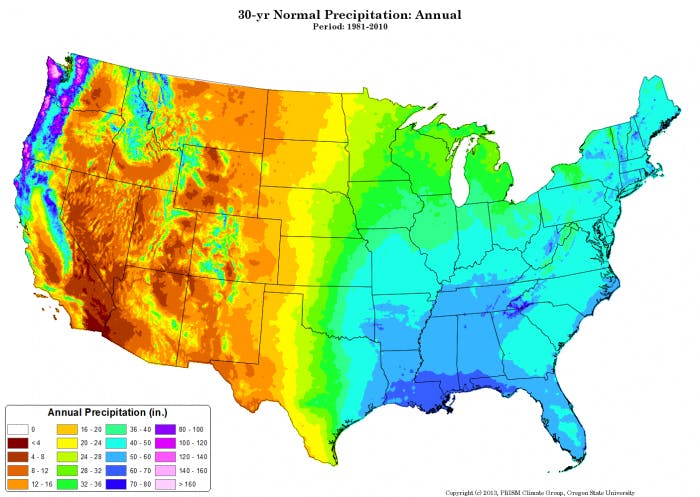

Freshwater has become increasingly hard to get. Even once you do get it, distribution is a whole story. It’s unevenly distributed, so rainfall in a wet region does nothing to help a dry region across the globe. How poor is this distribution? Of that meager 1% of the world’s freshwater which is readily available, only 10% of that is used!

And water is very heavy and expensive to transport.

That inequality extends to sanitation. According to UNICEF, 1 in 3 humans can’t get sanitary drinking water on a consistent basis. 297,000 children still die each year due to drinking contaminated water.

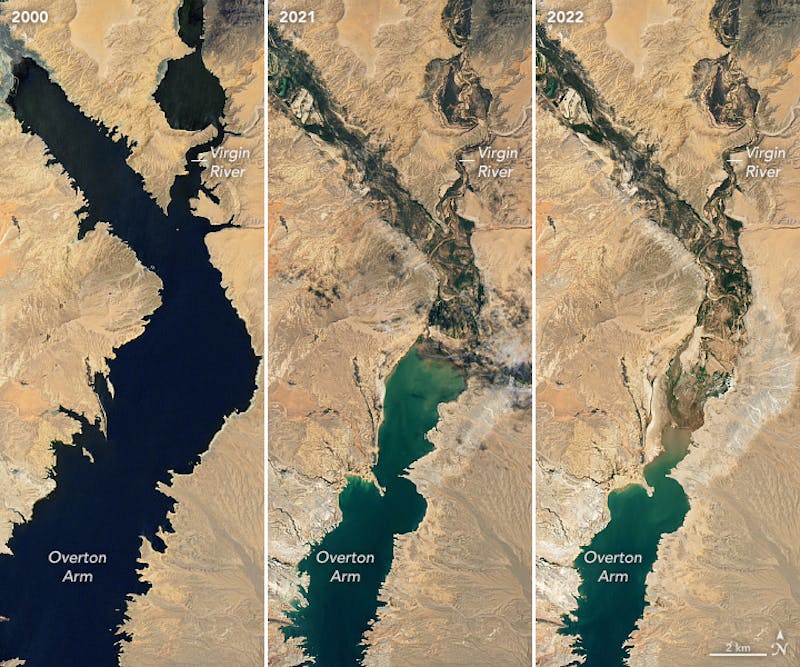

And then there’s climate change. Warmer temperatures mean less snow, which means less snowmelt. Climate change’s effect on lakes and rivers has been so obvious that you don’t even need words — the pictures really do speak for themselves.

Where our water goes

It’s easy to look at pictures/stats like these and think, “boy, we’ve got to do a better job conserving water!”

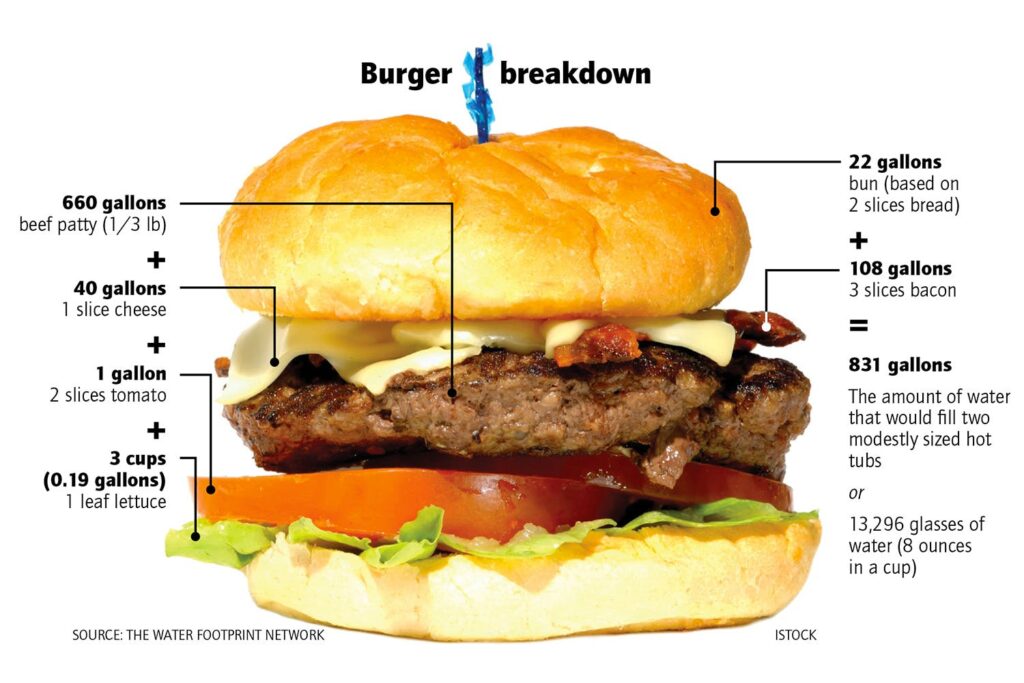

Yes, conservation is a good thing, and we should all conserve. But let’s be clear: most of our water goes to agriculture. Agriculture accounts for 42% of freshwater usage in the US, and 70% globally.

But don’t blame the farmers, they’re just meeting demand. And some foods require far more water than you’d think. It takes 680 gallons of water to produce a single pound of pecans, and a hamburger takes 630 gallons.

In the meantime, farms are tapping into groundwater (otherwise known as “ancient dinosaur water”) like never before. Water tables are plunging, aquifers are taking longer to refill, and countries are ramping up their water banking (long-term storage) in preparation for mega-droughts.

Oh, and foreign companies are buying up prime US farmland.

Things could get very interesting over the next decade.

Michael Burry and water

If water investing has one famous bull, it’s Michael Burry.

Michael Burry is the hedge fund manager played by Christian Bale in The Big Short. He’s one of the few who correctly predicted the 2008 housing crash, earning $100 million for himself and $700 million for his investors.

After closing his hedge fund Scion Capital in order to focus on personal investments, he vowed to focus all of his trading on a single sector: water.

Water is quite a broad sector, and there are a few different ways to invest in it:

- Buy water rights

- Invest in farmland

- Buy water-adjacent property

- Buy stocks of companies that deal in water infrastructure, including desalination, purification and wastewater treatment

- Buy water ETFs and funds

Since we love alternatives, we’ll focus mainly on water rights.

What are water rights?

Water rights are among the more interesting investments. Since you can’t just buy bodies of water, investors purchase the rights to land that contains a water source.

Ownership of water is associated with the land, not the investor. So when landowners sell a property, they relinquish any water rights they once had.

There are three main types of water rights: Groundwater, Litoral, and Riparian.

Groundwater rights

Groundwater rights are the right to utilize underground sources, including aquifers, water tables, even swamps.

Generally, if a farm has a rich well of water within the land, it is considered attached to the property. But groundwater extraction rights vary like crazy depending on location.

Littoral rights

Littoral rights are the right to utilize static bodies of water adjacent to their property. This includes oceans, lakes, and seas. The right to “use” this water has less to do with distribution, and more to do with personal recreation. Lakes, seashores, etc.

Littoral rights give the property owner whose land borders water reasonable use and enjoyment of the shore.

Riparian rights

Riparian rights focus on flowing water. It includes rivers, streams, and lakes that weave through a bunch of different properties.

To put it simply: If water flows over a property, riparian rights kick in, and things get much more complex. Allocation and distribution have to be managed along the length of the land it travels through.

Eastern vs Western US water rights

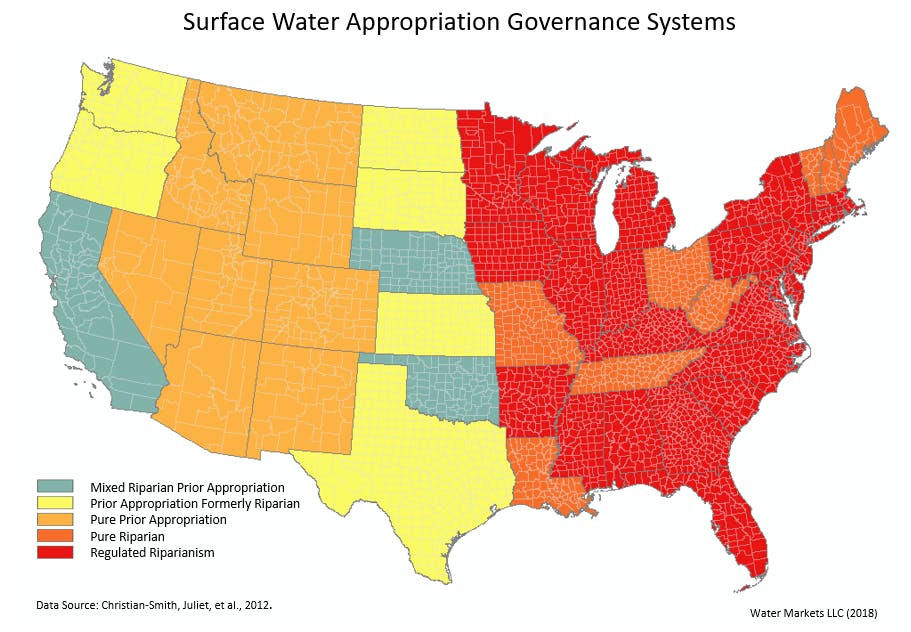

As we showed in the graph above, the eastern half of the US gets far more rainfall than the west. As such, there is a big difference between eastern and western states’ riparian laws.

People in the east can mostly do whatever they want with water that flows through their property, as long as it doesn’t impact others downstream. This includes drinking, watering, irrigating, etc. They can use any lakes, rivers, or other water bodies on adjacent land in a reasonable manner.

But in the arid west, states follow a very old system of Prior Appropriation Laws.

Prior appropriation means rights are determined by priority of beneficial use. Basically, whoever is first to utilize a body of water owns its rights. As long as they are putting the water to good use, they have a vested right to continue to divert and use that quantity.

The Colorado River Compact

However, these laws had glaring flaws. It incentivized upstream usage, downstream be “damned” (boom, water pun!) Even today it’s still a use it or lose it system that disincentivizes real efforts in sustainability.

The most important improvement in these laws has been the Colorado River Compact of 1922. This was a landmark agreement among 7 states that governed how water rights are set up and regulated the use of the Colorado River.

Prior to the Compact, states couldn’t agree on how to allocate water and use of the Colorado River. The Compact established the upper and lower Colorado basin, and created rules around who gets what.

The problem is that 1922 was a long time ago. Now, 40 million people depend on the Colorado River’s water for survival. Big cities. Denver. Tucson. Las Vegas. And of course, the Hoover Dam.

The amount of water allocated by the Compact is also more than the river produces now. D4 droughts, which are supposed to occur once every 50-100 years, now happen roughly every 7 years.

Trading water rights

So, demand outstrips supply. Based on that alone, you’re probably thinking that water rights would be a good alternative investment, right?

Well, not so fast. At least not in the US.

Some farmers have found selling their water rights is often more profitable than using them. The price of water doubled between 2000 and 2014, and some California farmers have sold their future water rights for $5,000 per acre-foot.

But remember that water rights are extremely political, and thus extremely risky. The Colorado River Compact is severely outdated and in need of reform. (Like, yesterday.)

There are a special class of rights called “golden water rights,” which pre-date the Compact and are likely immune to any new legislation. But for everyone else, the reality is that too much water was promised, and there’s not enough to go around. Something’s gotta give. Allocations will be cut.

In this way, water rights are an exception to the scarcity rule. Usually the more scarce something is, the higher the value. Yes, these water rights are scarce, but so is the water itself. And that water could be cut off at any time!

This is the conclusion that Michael Burry came to. He realized that buying water rights doesn’t make sense, because the water right itself doesn’t actually provide any value. It can go to zero at any time! The only way to make money from water rights is to hope someone else will pay a higher price for it later (i.e., greater fool theory.)

Burry realized the best way to invest in water is to invest in food. Agriculture. Farmland. Specifically, to grow food in water-rich areas, and transport/sell it to water-poor areas.

How to invest in water

Farmland

For the better part of the past decade, Burry has been snapping up water-rich farmland.

Burry grows almond crops on his farmland in locations with significant water resources, then transports the food to areas affected by drought. According to him, this redistribution is sustainable.

Burry’s outlook on water shows that investors can have a positive impact on the water shortage crisis while still making a profit.

Water-adjacent property

Nevada is one of the driest US states, with 2.7m residents affected by droughts each year. There are only a few significant rivers in the state, one of which is the Humboldt River.

Upon visiting the region, eagle-eyed hedge fund manager Disque Deane Jr. spotted an investment opportunity. He bought a dilapidated 11,000-acre property for sale in the rural town of Winnemucca.

The property wasn’t in great condition; it had unusable soil and little grass. But Deane only cared about the land’s water rights, which granted him access to a significant allotment of the Humbolt’s flowing water. He wants to build a portfolio of Nevada water rights, with this property as the cornerstone.

Political risk aside, for most people, accumulating a portfolio of water rights like this would be undoable. But there are plenty of other options.

Managed water rights funds

Investors can buy managed funds that invest in all sorts of water companies. But what’s more interesting to me is funds that invest directly in water rights.

The Argyle Water Fund invests in Australian water entitlements, farmland, and agricultural infrastructure. They own and maintain a diverse portfolio of water entitlements (perpetual water rights) across rivers and aquifers.

Water financing

Another interesting model has been bought to life by debt investors WaterEquity. They have a three-step process:

- WaterEquity lends money to an institution in developing markets (India, Indonesia)

- The institution gives a micro-loan to a client to build a sustainable water resource, such as a sanitation center.

- The client then pays back the loan with interest, which flows back to WaterEquity.

The company has a 99% global repayment rate. (Compare that to the BNPL industry which has 40% late payment rates)

Equities & Indexes

Mainstream options outweigh the alternative ones. There are many publicly-listed companies, mutual funds, and ETFs that operate in the water sector.

A few of note include:

- Danaher Corp ($DHR). A company that operates water treatment and testing facilities. Excellent performance. Up 252% over the past 5 years.

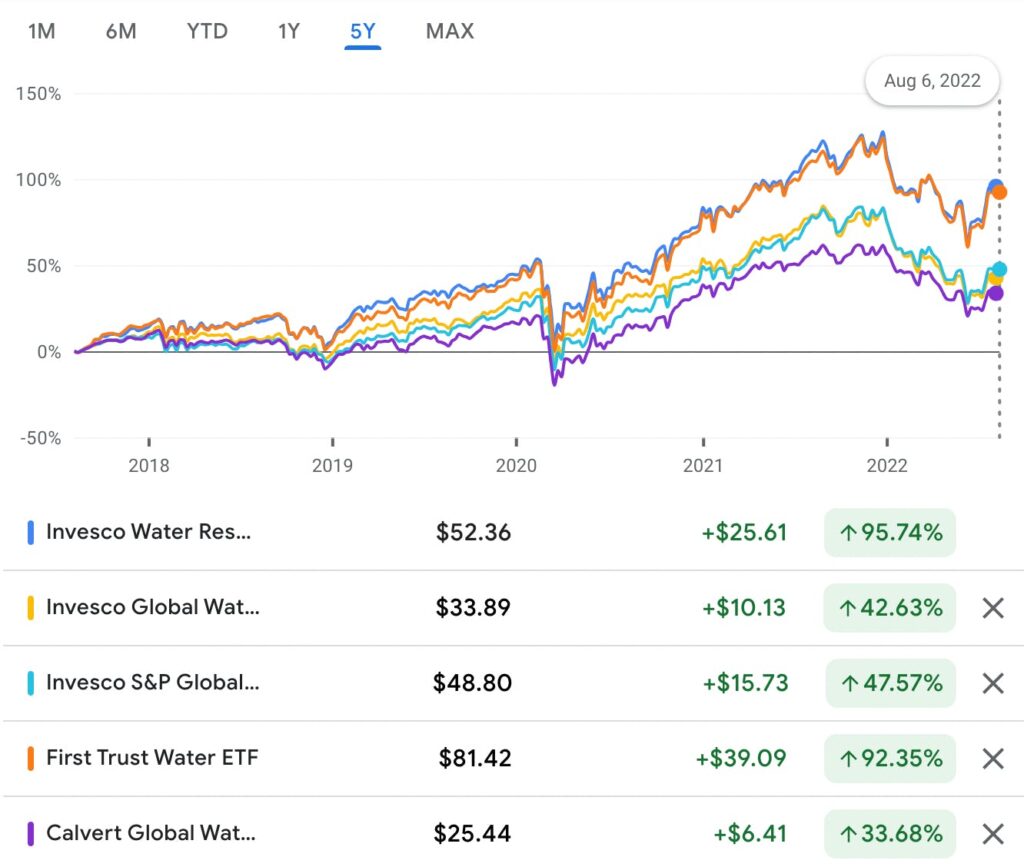

- Invesco Water Resources ETF ($PHO). At $1.7b in assets, PHO is the world’s largest water ETF. It contains 38 mainly US companies, and has done well. Up 18.5% over 5 years (beat S&P) but up 10.9% over past 10 (lagged S&P)

- Invesco Global Water ETF ($PIO). Similar to $PHO, but with a focus on global companies. Up 11.3% over the past 5 years.

- Invesco Global Water Index ETF ($CGW). Instead of companies, this fund invests in utility and service providers. Half are in the US, half overseas. Up 14.6% over the past 5 years.

- First Trust Water ETF ($FIW). Like CGW but more globally-focused. Tracks the OMS global water index.

- Calvert Global Water Fund ($CFWAX). Tracks their own self-created index. 3x as large as FIW. Up 12.3% in past 5 years.

The ethics of water investing

Investing in water comes with an inherent ethical dilemma. Is water a human right? If so, then shouldn’t it be free for everyone? Why should anyone be able to profit off a fundamental human need when so many go without?

As I said above, water is local. If it were easy to transport, that would be one thing. But you can’t easily get water from the Amazon over to South Sudan.

There are many ways to invest in water ethically. Investors can purchase equity in a water tech company aiming to solve the supply squeeze, or buy allotments and distribute it to local drought-affected farmers at a fair price.

Personally, I avoid investing in bottled water companies like Blue Triton. Originally under the Nestle brand, this business became controversial for sapping water from the source, bottling it up, and selling it at a profit. For context, a permit for accessing groundwater costs $2,100 per year, and Nestle/BlueTriton sells over $7.8bn of bottled water every year.

Unfortunately, Nestle is just one of many bottled water companies drawing water to the point that creeks and river beds run dry, killing ecosystems.

Desalination

Desalination is another way to invest in water. Plants are expensive to build, but the payoffs are huge.

Israel is one of the world’s driest countries, so in 2000, the Israeli government invested $400m into constructing the world’s largest desalination plant, the Sorek desalination facility. The plant has been running for around a decade, processing ±360m cubic meters every year and providing a thousand liters of drinking water for just 58 cents.

Israel, previously threatened by catastrophic draught, is now one of the few countries that has more water than it needs. They are the leaders in desalination and have provided a sustainable blueprint for other nations to address their water shortage crises.

Australia’s free-market water trading

Just like Israel, Australia is a relatively dry country, and it has developed an innovative water rights market.

Originally, water rights were tied to the land, just like in the US and UK. But this led to monopolization within the industry, and by the 1980s, pressure was starting to mount. So states across Australia introduced water allocations to farmers. Instead of buying land to own water, water rights became independent from land.

What this did is create a massive private market for water rights. Businesses could now trade these allocations as they saw fit.

Those with an allocation can access as much or as little water as they are allocated, as long it’s under the cap. So a farmer who only uses half of their water allocation in a year can sell the other half to another farmer who needs it (through a pretty simple form)

Similar to trading carbon credits; this solution is more efficient and also has a positive impact on long-term sustainability.

Closing thoughts

On the spectrum of things people want vs need, nothing ranks higher than food and water. There is still plenty of water in the world, but distribution is another story.

The western US has a very messy water situation, and its antiquated laws probably aren’t helping. Perhaps privatizing the water rights market will. But water isn’t just a US issue; it’s a global issue. Every region faces its own unique challenges, and has to figure this out for themselves.

In the meantime, buying water rights seems fraught with political risk, and mainstream water investment options are low-growth plays. They trade a bit like utilities (except worse, because they don’t pay dividends.)

If you’re bullish on water (what an odd concept, like who isn’t bullish on water?) I think your best bet is to follow Burry and buy farmland in water-rich areas.

One thing’s for sure — the growing scarcity of clean, fresh water suggests that its value as a commodity will only increase. Humans are never going to stop needing the stuff, so we’re going to have to figure it out. Perhaps in the future we’ll see massive water pipelines?

I mean after all, we’ve done it with oil.

But that’s for a future issue.