Do you want to pay off debt fast fast? If you owe money on car loans, student loans, or credit card bills, you’re not alone. According a recent survey, 43% of Americans carry over a credit card balance each month. In fact, the total credit card debt has reached its highest point ever, surpassing over $1 trillion.

Table of Contents

What is debt?

Debt is essentially money owed by one party to another. While some may argue that there is no such thing as good debt, borrowing money and taking on debt is often the only way some people can afford to purchase big-ticket items such as a home, a car, or go to college.

No matter what type of debt you have, it’s always a good idea to pay if off as quickly as possible, especially credit card debt. Today I’m sharing how to pay off debt fast with a low income. Use these creative ways to pay off debt so you can reach your financial goals faster!

Related Posts:

- 50 creative ways to save money on a tight budget

- 10 habits of debt-free people

- 10 fast ways to save money without even trying

1. Write down all your debt

This is the step that most people skip because they feel guilty about their debt. They are afraid to find out how much they really owe or are unsure how to figure out this information.

When people only pay the minimum payments, thinking this is the best method to get out of debt, the credit card and loan companies love this! This is because minimum payments can take several years to pay off. And that’s only if you don’t add to the balance in the meantime.

Writing down all your debt may make you want to run and hide, but it’s the essential first step in creating a solid action plan to pay off debt fast.

The best way to find out how much you owe is to contact the original creditor (for example, the credit card company, gym, or doctor’s office) and ask them for the amount. Another way to find out this information is to review your credit reports.

Once you’ve written down all your debt, you’ve just taken the first step which is also one of the hardest parts. Congratulations! You’re already on your way to paying off debt faster and living your most authentic life.

From this day forward, that number is only going to go down. If you can do this first step, there’s no stopping you from tackling your debt once and for all.

2. Stop using credit cards and switch to cash

If you really want to pay off debt faster, you’ll want to stop using your credit cards. This can help prevent adding new debt to your balance. Instead, I recommend using cash as your primary method of payment.

When you’re going shopping, make a list of what you need to buy and bring only the amount of cash you plan to spend during your errands. This can help you avoid making impulse purchases.

When creating your monthly budget, a popular method is to use the cash envelope system. This is an easy way to track exactly how much money you have in each budget category for the month. You’ll keep your cash tucked away in envelopes (use one envelope for each budget category). This is a great way to help you stop overspending and pay off debt even if you have no money.

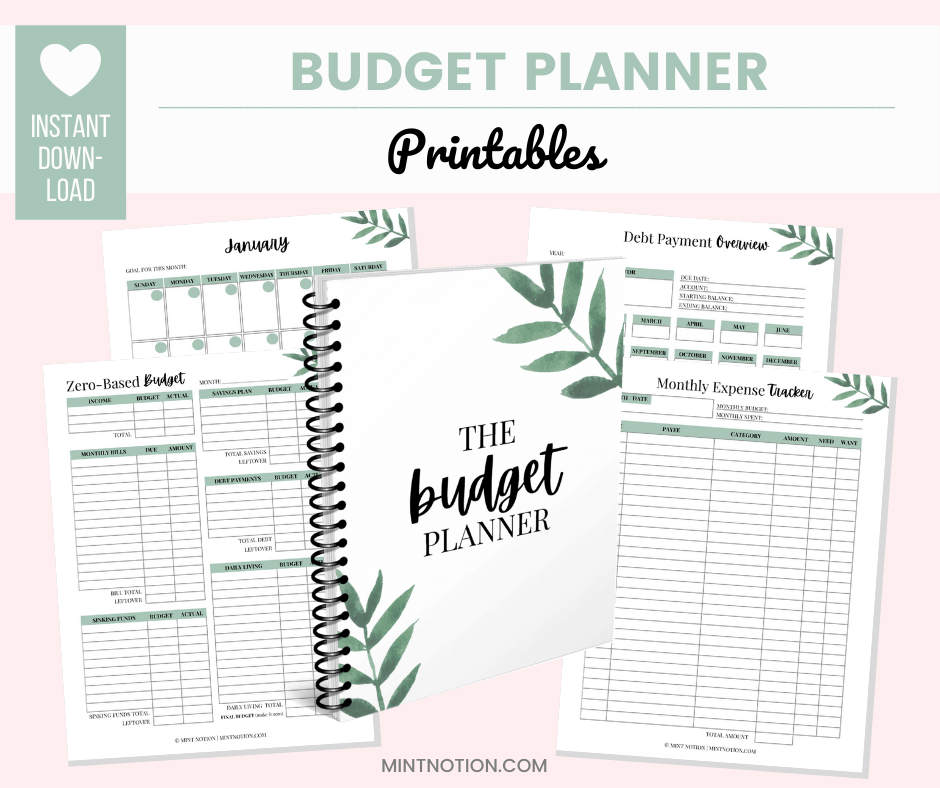

Need some help getting started? You can grab my Budget Binder printables here. These are the same worksheets I use every month to organize my finances.

3. Figure out where your money is going with a budget

Now that you know exactly how much money you owe and you’ve stopped adding more debt to your balance, the next step is to create a budget. This is simply a plan for how you wish to spend your money.

Creating a budget can help you align your spending with your goals, such as paying off debt or saving up for a down payment on a home. While there are many ways to do this, one of the most effective budgeting methods is to budget-by-paycheck.

Instead of looking at your month as a whole, such as with traditional budgeting methods, paycheck-to-paycheck budgeting means you’ll be able to see which paycheck pays for which expenses. This will help you plan ahead so you’ll know when money is coming in (income from your job or a side hustle) and when money is going out (bills, birthday present, groceries, and so on).

If you’re interested, you can download my Paycheck Budgeting worksheet here and follow my easy step-by-step guide to get started.

4. Find your “WHY”

If you want to be successful with your budget, it’s important to find your “why”. Knowing your why is the essential first step in figuring out how to achieve the goals which excite you.

Identifying your why can also help you stay motivated and take the risks you need to get ahead. For example, if your goal is to pay off credit card debt, knowing WHY you’re making temporary spending cuts can make it easier for you to be successful.

Here are a couple of exercises to help you find your WHY:

Make a list of things you love to do

Each of us is unique. Maybe you enjoy spending time with family and friends, or working on a hobby, or traveling, or your job. Your “why” can also be a person. Maybe your why is your partner, your child, your parent(s), your sibling, and so on.

Organize your priorities

Now that you’ve created your list, it’s time to refine and organize your priorities. Look at your list and for each item (or person), ask yourself why you love it. Why is it important to have in your life? You’ll find that by answering these questions, you’ll discover what’s really important to you. This will help you refine your list and put your priorities at the top.

5. Unsubscribe from retailer emails

If you find yourself being tempted to spend money every time a sales email pops up in your inbox, then it’s time to click “unsubscribe”. I recommend unsubscribing from ALL retailer emails to avoid the urge to impulse spend. This also includes deleting any shopping apps you have on your phone.

Still having trouble kicking your shopping habit? Read next: 10 tricks to help you stop spending money on clothes

6. Try the Debt Snowball method

Most people pay only the minimum monthly payments on their credit cards and other debts. But if you’re serious about paying off all your debt fast, you may want to consider using the debt snowball method.

Just like packing more snow into a tight ball so it gains momentum and speed as you roll it down a hill during winter, this debt reduction strategy can be a highly effective way to get out of debt fast.

How the debt snowball method works

- Step 1: List all your debts from smallest to largest. If two debts have similar balances, list the one with the higher interest rate first.

- Step 2: Make minimum payments on all your debts except the smallest.

- Step 3: Pay as much money as possible on your smallest debt.

- Step 4: Once the smallest debt is paid off, start putting that extra money towards the next smallest balance. Repeat until each debt is paid in full.

7. Try the Debt Avalanche method

Similar to the debt snowball method, except instead of listing all your debt from smallest to largest, you list debts by their interest rate – from largest to smallest interest rate.

How the debt avalanche method works

- Step 1: List all your debts by their interest rate, from largest to smallest. If two debts have a similar interest rate, list the one with the higher balance first.

- Step 2: Make minimum payments on all your debts except the one with the highest interest rate.

- Step 3: Pay as much money as possible on your debt with the highest interest rate.

- Step 4: Once the highest interest rate debt is paid off, start putting that extra money towards the next debt on your list. Repeat until each debt is paid in full.

If you do the math, the debt avalanche method shows that you’ll pay less interest. Ideally, this will be the most rational debt payoff method to follow because you’ll save the most money in interest.

However, humans aren’t always rational beings, which means you may have the most success using the debt snowball method. This is because studies have shown that people with large balances are more likely to stay motivated to pay off debt faster if they focus on smaller balances first.

Those “quick wins” can help you stick to your debt payoff plan for the long term. To help you keep everything organized, you can use my Debt Payoff Tracker printable here.

8. Ask for a lower interest rate and negotiate your monthly bills

If your credit card interest rates are high, you may want to consider giving them a call and asking for a lower interest rate. Many people don’t realize this, and a quick phone call could save you hundreds or thousands of dollars in interest. The worst anyone could say is “no” and you won’t know until you ask.

Beyond credit card interest, I also recommend going through your monthly bills and seeing which ones can be reduced or eliminated. To help you save time, consider using a free tool like Trim to help you do this.

Trim is a free virtual assistant that constantly helps you to save money. It’s essentially a robot that analyzes your accounts to find recurring subscriptions and determine where you can save money. Trim has saved folks more than $8,000,000 and can help you save money quickly too. Click here to see how much money Trim can save you.

9. Get a side hustle

If you’re trying to pay off debt faster, you’ve probably got inspired by a debt payoff story you read at some point. The headline of these stories usually look something like this: “I paid off this large sum of money in a short period of time”.

You may be thinking…

How is this even possible?

That must be nice for them.

They were earning a high-income – no wonder it was easy for them to pay off debt fast.

I’m happy that worked for them, but it doesn’t apply to normal people.

No matter what thoughts may be going through your mind when you read those debt payoff stories, one thing I notice is a lot of people come up with excuses for why they are stuck in their situation.

After reading dozens of debt payoff journeys, many of these success stories boil down to a few key steps. I apologize if this comes off as “tough love”. I personally feel that sometimes getting tough love is the best way to get motivated to reach my goals.

- Taking full responsibility for their situation.

- Believing that they CAN change and develop better spending habits.

- Creating a budget aligned with their goals to become debt-free.

- Finding ways to increase their income and throwing all that extra money towards paying off debt. This is the biggest step in paying off debt faster!

- Understanding that cutting back their spending right now is only temporary. Live like no one else now, so you can live like no one else later.

At the end of the day, finding ways to increase your income while managing lifestyle inflation is the best way to pay off debt fast. Getting out of debt is not easy, and it’s much more difficult when you’re putting all your effort on pinching pennies instead of focusing on bigger wins, such as making extra money.

There are many ways to boost your income. Whether it’s taking on more hours at your current job, negotiating a raise or applying for higher-paying jobs, there are lots of ways to earn more money. Other ideas include finding a second job, getting a side hustle or starting your own business.

Here are some popular ways to make extra money. Choose the one that sounds most interesting to you!

- Get paid to do online surveys. This isn’t going to make you rich, but it’s one of the easiest ways to make extra money in your spare time. Survey Junkie is a good place to start, plus it’s free to join.

- Start your own blog. Making money from a blog does take time, but it’s very rewarding because you get to run your own online business from home (or anywhere there’s an internet connection). If you’re interested, you can follow my easy step-by-step guide here. Plus, you’ll get a free domain name when you sign up through my tutorial.

- Become a freelance proofreader. You can earn up to $40K by working from home as a proofreader. If you have a good eye for detail, this can be a great option for you. Learn more by checking out this free workshop.

- Flip items for profit. You can make extra money by flea market flipping. This couple earns over $100,000 by flipping items for cash. You can learn more about how to get started in their free workshop.

- Become a fashion stylist. is looking for aspiring fashionistas just like you to join their team as an independent stylist — no experience required! You can learn more here.

- Get paid to lose weight. Companies, such as Healthy Wage, will actually pay you to reach your fitness goal. Make a bet, lose the weight you say you’re going to lose, and get paid. You can learn more here.

10. Cut back on your expenses

No one likes to cut back on their expenses. And it’s especially difficult to change the spending behavior that got you into debt in the first place.

People get into debt for different reasons. Whether it’s school, medical bills, a job loss, or living beyond their means. No matter what the reason is, it’s important to take responsibility and find ways to reduce or eliminate expenses to help you pay off debt faster.

Remember, these cut backs are only temporary while you’re trying to save money to pay off debt. Once you’ve paid off your debt, you can then create a new budget plan for how to spend your money.

Cut back on your biggest expenses

For most people, their biggest expenses include housing (rent or mortgage), transportation, and food. Finding ways to reduce theses expenses is a good place to start if you want to pay off debt fast.

I share some of the ways we’ve cut back on our biggest expenses in this post: How I save 50% of my income. Of course the ways we’ve cut back on these expenses may not work for everyone. It’s important to find ways that work best for you and your lifestyle.

Cut back on unnecessary spending

Once you’ve found out where your money is going by tracking your spending and creating a budget, the next step is to look for ways to cut back on unnecessary spending. You can use my Tracking Expenses printable to do this if you’d like.

Read Next: 15 fast ways to cut your monthly expenses

This doesn’t mean that you need to live on a bare-bones budget and feel like you’re depriving yourself of the things you love. If anything, living on a bare-bones budget is not sustainable or recommended, unless you feel that it’s absolutely necessary to help you pay off debt faster.

Instead, I recommend cutting back on unnecessary spending and finding ways to live more frugally. Here are a few simple ways you may want to consider trying to help you save more money:

- Eat more meals at home. I like to create a meal plan to help me do this.

- Make coffee or tea at home (or at the office) instead of going to the local café.

- Bring your lunch to work instead of eating out.

- Drink more water and less sugary drinks.

- Shop by the flyers to see what’s on sale at your local grocery store.

- Walk to work (or take public transportation) if you can.

- Use cash-back websites like Rakuten when shopping.

- Shop your closet before buying new clothes. Try my 30-day shop your closet challenge!

- Try store brands or generic brands to save money on food or toiletries.

- Have a no-spend month or try a money challenge to help you save more.

- Force yourself to wait before making a big purchase. You may find that you don’t really need it.

- Take advantage of your local library for free books, movies, and entertainment.

- Look for free things to do in your city or use Groupon to get discounts.

- Use Trim to cancel subscriptions and memberships you don’t need anymore.

- Give yourself an at-home manicure / pedicure.

- Exercise outdoors or at home if you no longer use your gym membership.

11. Put any extra money towards paying off debt

If you get a pay raise at work or extra income from a side hustle, this doesn’t mean that you should give yourself permission to spend more money. This is called lifestyle inflation – increasing one’s spending when income goes up. Lifestyle inflation often continues each time someone gets a raise or earns more money, which can make it difficult to get out of debt or reach other financial goals.

To fight lifestyle inflation, you’ll want to prioritize your goal to pay off debt fast. Once your emergency fund has been reached (I recommend having at least $1,000 in your emergency fund), then you can throw any extra income towards paying off debt.

Read next: 12-week money challenge: Save $1,000 to build your emergency fund

I can appreciate how this doesn’t sound like fun, but these are temporary actions needed to help you reach your goal. Once your goal has been reached, then you can decide how you would like to adjust your spending.

12. Celebrate every win

Just because you’re working hard to pay off debt faster doesn’t mean that you can’t reward yourself along the way. In fact, each time you hit a milestone in your debt free journey (such as you’ve paid off a balance or you’ve paid off a certain percentage of all your debts), you should celebrate every win.

It’s important to reward yourself when paying off debt because your milestones do matter and it’s acknowledging that you’re getting closer and closer to financial freedom.

How you choose to reward yourself is up to you. The possibilities are endless – just make sure that it fits within your budget and aligns with your goal.

For example, you can go out for dinner, get your nails professionally done, buy that clothing or makeup item you’ve been wanting, or go on a vacation. When I was in college, one thing I didn’t want to sacrifice was my travel budget. While paying for my college tuition, I found affordable ways to travel and made sure that I set aside enough money in cash to pay for my trips.

This meant having to say “no” to a lot of things, such as going out for drinks every weekend with friends, not owning the latest tech gear, and cutting back on my shopping budget. But I wanted to make sure that I could still have fun without sabotaging my financial goals.

Final Note

Yes, you can get out of debt! I know it may seem like a never ending journey right now, but you’ve already taken that important first step.

By doing your own research, you can equip yourself with the head knowledge you need to help you reach your goals. And that’s what personal finance is really about — it’s 80% behavior and 20% knowledge.

No matter what your big goal is, having a budget can help you get there. This is about making a plan for your money. If you’re spending is aligned with your goals, this can help you save more money each month so you can pay off debt faster and reach your goals.

It’s not always easy in the beginning, but with more practice, you’ll find the right budget that works for you. If you’re ready to get started, you can grab my printable Budget Binder here. It’s the same worksheets I use to organize my finances. You’ve got this!