Why is saving and investing important?

Saving and investing are both important to consider in your future planning. Through saving money, your money is kept safe, and easy to access should you need it. By investing early over time, your money grows in value, benefiting from the magic of compounding.

Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals.

“First, it establishes good savings habits that will apply universally, regardless of what your savings goals are. Second, the sooner you start, the longer your money has to grow over time.”

As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as the cost of living rises. Over the long term, investing can smooth out the effects of weekly market ups and downs.

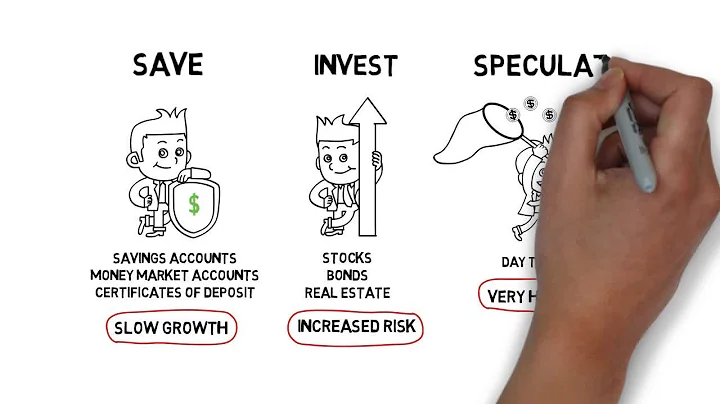

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

Capital investment allows for research and development, a first step to taking new products and services to the market. Additional or improved capital goods increase labor productivity by making companies more efficient. Newer equipment or factories lead to more products being produced at a faster rate.

You can only live your life with unparalleled confidence if you know that you have set up a savings plan for your future. This will also help students make smart decisions related to their future studies or jobs or the career they want to excel in. In fact, it develops confidence among students in their abilities.

- Make Money on Your Money. You might not have a hundred million dollars to invest, but that doesn't mean your money can't share in the same opportunities available to others. ...

- Achieve Self-Determination and Independence. ...

- Leave a Legacy to Your Heirs. ...

- Support Causes Important to You.

By investing, you give your money a chance to grow and maintain its purchasing power over a longer period of time. So, if you're planning to save money for the future, investing could provide a better return than simply keeping your money in the bank.

The difference between saving and investing

Saving can also mean putting your money into products such as a bank time account (CD). Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares in a mutual fund.

What are the benefits of saving money?

Having adequate savings enables you to live a more fulfilled life. You are more likely to be less stressed about your future goals like retirement or unexpected expenses like healthcare. Savings allow you to be relieved and at ease, knowing you have sufficient funds to navigate different situations in life.

Answer and Explanation:

Saving can be done continuously over time. ''Savings'' refers to amounts that households earn but do not spend, such as money held in a savings account.

Meet Life Goals

Whether you've always dreamed of buying a house, purchasing your dream car or sending your kids to college with all expenses paid, saving money allows you to reach your life goals. These are often medium- and long-term goals that take multiple years to achieve, and that's where savings can help.

Savings are an important aspect of accumulating wealth. The total amount of money saved might be shown as a bank balance. Increasing one's savings will undoubtedly improve one's fortune. However, there are other components of wealth, such as plants, inventory, and so on, so this is not the only way to increase wealth.

A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you grow money over the long term, making it a strong option for funding expensive future goals, like retirement.

Saving and investment theory is also referred to as income theory and was first used by economist Thomas Tooke. The main goal here is to explain variations in the price level or the value of money as per the classical investment theory view, assuming that the economy is always in full employment equilibrium.

Through saving money, your money is kept safe, and easy to access should you need it. By investing early over time, your money grows in value, benefiting from the magic of compounding. Remember that investing early, along with compound interest, can result in higher investment amounts versus a late investment start.

Saving is generally seen as preferable for investors with short-term financial goals, a low risk tolerance, or those in need of an emergency fund. Investing may be the best option for people who already have a rainy-day fund and are focused on longer-term financial goals or those who have a higher risk tolerance.

Your investments can make money in 1 of 2 ways. The first is through payments—such as interest or dividends. The second is through investment appreciation, aka, capital gains. When your investment appreciates, it increases in value.

Investing in stocks offers the potential for substantial returns, income through dividends and portfolio diversification. However, it also comes with risks, including market volatility, tax bills as well as the need for time and expertise.

What are two reasons to save instead of invest?

Saving money means that it is protected from any risks that may occur in the stock market or other investment opportunities. This is particularly important for individuals who have low risk tolerance and cannot afford to lose money that they have saved. Liquidity is another reason why people save instead of investing.

Saving is ultimately the first step to investing because, without it, you're not ready to take on the risk of putting your money in the market. To make sure you are earning the greatest return on your savings, especially when you are relying on it as an emergency fund, use a high-yield savings account.

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. This is called the 50/30/20 rule of thumb, and it provides a quick and easy way for you to budget your money.

Investing is riskier than saving, but can also earn higher returns over the long term. Even accounting for recessions and depressions, the S&P 500 (composed of the U.S.'s 500 largest companies) has averaged just over 11 percent per year in returns since 1980.

- It ensures your freedom and autonomy. ...

- It's legal tender. ...

- It ensures your privacy. ...

- It's inclusive. ...

- It helps you keep track of your expenses. ...

- It's fast. ...

- It's secure. ...

- It's a store of value.