What are 3 common features most financial institutions offer?

All financial institutions usually offer basic banking services (checking and savings accounts, consumer loans, etc.) with larger ones offering a fuller range of services (credit cards, mortgages, foreign currencies, etc.).

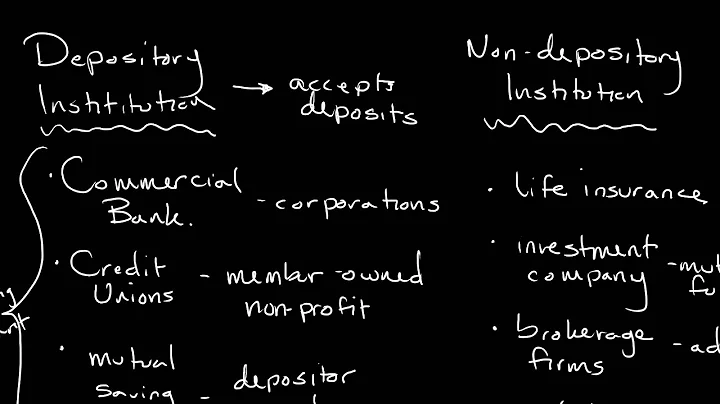

Banks, Credit Unions, and Savings & Loans

These financial institutions accept deposits and offers checking and savings account services; make business, personal, and mortgage loans; and provides basic financial products like certificates of deposit (CDs).

Today, most large banks offer deposit accounts, loans, and limited financial advice to both consumers and businesses. Products offered at retail and commercial banks include checking and savings accounts, certificates of deposit (CDs), personal and mortgage loans, credit cards, and business banking accounts.

They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions. These three types of institutions have become more like each other in recent decades, and their unique identities have become less distinct.

Financial institutions are entities that facilitate financial transactions and act as intermediaries in financial operations. There are various functions of financial institutions, including banking services, capital formation, monetary supply regulation, pension fund services, and the economic growth of a nation.

Financial features are characteristics of financial products or instruments that determine their value, risks, and benefits. Here are some common types of financial features: Interest rate: The interest rate is the cost of borrowing money or the return on investment.

- Insurance Companies. Insurance companies are businesses that offer protection against potential future losses. ...

- Credit Unions. ...

- Mortgage Companies. ...

- Investment Banks. ...

- Brokerage Firms. ...

- Central Banks. ...

- Internet Banks in the UK. ...

- Savings and Loan Associations.

All financial institutions usually offer basic banking services (checking and savings accounts, consumer loans, etc.) with larger ones offering a fuller range of services (credit cards, mortgages, foreign currencies, etc.).

All services related to money are considered financial services. Banking, mortgages, credit cards, payment services, tax preparation and planning, accounting, and investing are types of financial services industries. Financial services are frequently the exclusive domain of businesses and professionals.

- Checking Accounts. An account at a financial institution that allows for withdrawals and deposits. ...

- Savings Accounts. ...

- Money Market Accounts. ...

- Certificates of Deposit. ...

- Mortgages. ...

- Home Equity Loans. ...

- Auto Loans. ...

- Personal Loans.

What are three examples of financial institutions quizlet?

There are three main types of financial institutions: banks, credit unions, and savings and loans.

For a smooth flow of deposits and withdrawals, the banks provide chequebooks and other things such as ATMs and debit cards. However, access to investment products is not an ordinary feature of ant banks, and neither do they provide any access to such products.

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

Financial institutions provide important economic functions, such as managing the payment system of an economy, as well as providing liquidity, maturity, and denomination intermediation and diversification services, as well as providing investing expertise, search, payment, and monitoring services, among other services ...

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions.

What is the primary function of financial institutions in the economy? They keep money flowing throughout the economy among consumers, businesses and government.

The three-statement model links your company's income statement, balance sheet, and cash flow projections together so you can project your future cash position and financial health.

They are saving, investing, financial protection, tax planning, retirement planning, but in no particular order. Here are the 5 aspects of a complete financial picture: Savings: You need to keep money aside as savings to cover any sudden financial need.

The main elements of a financial plan include a retirement strategy, a risk management plan, a long-term investment plan, a tax reduction strategy, and an estate plan.

| Bank | Forbes Advisor Rating | ATM Network |

|---|---|---|

| Chase Bank | 5.0 | 15,000+ Chase ATMs |

| Bank of America | 4.2 | 16,000+ ATMs in the U.S. |

| Wells Fargo Bank | 4.0 | 11,000 |

| Citi® | 4.0 | 65,000 |

How do financial institutions make money?

They make money from what they call the spread, or the difference between the interest rate they pay for deposits and the interest rate they receive on the loans they make. They earn interest on the securities they hold.

- Best Banks of March 2024.

- Capital One Bank.

- Chase Bank.

- Axos Bank.

- Discover Bank.

- Synchrony Bank.

- TD Bank.

- Regions Bank.

- Checking accounts.

- Savings accounts.

- Debit & credit cards.

- Insurance*

- Wealth management.

The 5 most important banking services are checking and savings accounts, loan and mortgage services, wealth management, providing Credit and Debit Cards, Overdraft services. You can read about the Types of Banks in India – Category and Functions of Banks in India in the given link.

But compared to banks, credit unions tend to be smaller, operate regionally and are not-for-profit. In many instances, they offer lower rates on loans, charge fewer fees and offer better interest rates for deposit accounts than traditional banks.