Wells Fargo will give refunds to more than 570,000 auto loan customers who were also charged for auto insurance without their knowledge.

The bank said in August it will begin sending letters and refund checks to customers, most of whom already had insurance of their own, and some who had their cars repossessed, in part, because of the practice. Wells Fargo will make $80 million in payments --$64 million in cash and $16 million inaccount adjustments -- the banksaid Thursday.

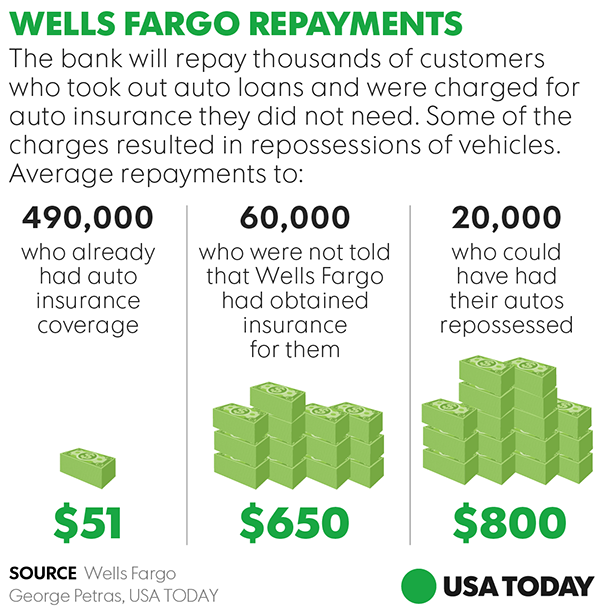

Auto loan customers were required to haveinsurance and Wells Fargo says its contracts permitted a policyto be ordered if there was no evidence customers had done so. However, about 490,000 customers charged for the auto insurance already had coverage for some or all of their loan's duration, according to a review of the bank'spolicies from 2012 to 2017. Refunds for these customers will total $25 million.

This is just the latest predicament for one the nation's largest banks. In practices that echo this insurance process, Wells Fargo was fined $185 million in September 2016 by the Consumer Financial Protection Bureau and the Los Angeles City Attorney's office for openingas many as 2.1 million deposit and credit card accounts without customers' permission. Earlier this month, the bank reached a $145 million settlement in a class-action suit filed by customers whose credit scores were hurt by those practices.

Lower your auto insurance costs: Find the best car insurance of 2023

After auto loan customers complained, Wells Fargo began a review of the insurance program in July 2016 and ended the program two months later, it says.

“In the fall of last year, our CEO and our entire leadership team committed to build a better bank and be transparent about those efforts,” said Franklin Codel, who heads Wells Fargo Consumer Lending, which includes the dealer services unit, in a statement. “Our actions over the past year show we are acting on this commitment.”

Beyond the customers charged for insurance when they already had coverage, another 60,000 were not told about Wells Fargo's obtaining insurance for them in violation of state laws. Refunds for this group will total about $39 million.

For 20,000 customers, the added cost of insurance procured by Wells Fargocould have led to repossession of their vehicle. These customers will get payments beyond the financial harm caused, Wells Fargo says, totaling $16 million.

Wells Fargo issued its statement after The New York Times reported more than 800,000 of the bank's car loan customers were charged for unneeded auto insurance. That number of affected customers, which is higher than Wells Fargo's figure announced Thursday, comes from aninternal report for the bank prepared by consulting firm Oliver Wyman, and obtained by the Times.

In addition to having cars repossessed, customers also incurred late fees, insufficient funds charges and credit report damages, according to report. Such charges occurred because a customer who set up automatic payments of $275 monthlywas charged $325 with the insurance -- provided by National General Insurance. Added without their knowing it, the fee could result in account overdrafts, the Times says. Customers could also fall behind on their car payment, since loan interest and interest on insurance were deducted before payment on the car loan principal, according to the Times.

At Consumers Union, the policy arm of Consumer Reports, programs director Chuck Bell said Wells Fargo's practice "has all the hallmarks of a predatory and unsafe financial product."

Wells Fargo "raised consumer charges in a non-transparent way, and created an escalating cascade of financial and economic harm for borrowers," Bell said. "It's a great reminder of why consumers need strong, active oversight of unsafe products that can blow up in their face. ... How do you begin to make resititution to people who lost their cars and their economic livelihood, and had their credit damaged?"

The bank's latest revelation led to criticism in Washington, too. "Wells Fargo has repeatedly preyed on servicemembers, homeowners, minorities, and, it seems, consumers seeking any kind of financial product from them," said Rep. Maxine Waters, D-Calif. "This disgraceful, illegal, and widespread misconduct is exactly why I’ve been working on legislation that breaks up banks—like Wells Fargo—that repeatedly engage in consumer abuses so that they can never harm consumers again.”

In a letter Friday to Federal Reserve Chair Janet Yellen, Sen. Elizabeth Warren, D-Mass., called for the Fed to remove Wells Fargo board members who served during the bank's fake accounts scandal -- something she requested last month, also.This newreport on the unnecessary auto insurance charges,she wrote, "makes the case for removing these Board members even stronger."

Wells Fargo customers interested in knowing more about the bank's refund plan can visit its Dealer Services web site.

Follow USA TODAY reporter Mike Snider on Twitter: @MikeSnider.