Table Of Contents show

Last Updated on 10 February, 2024 by Rejaul Karim

There are many moving average types to choose from, and which one you should go for depends not only on your trading style but also on the characteristics of the strategy you trade.

WVAP, or Volume Weighted Average Price, is a volume-weighted moving average that’s used primarily by day traders to find profitable entries and exits. However, the indicator is also used by bigger market players, to achieve a smoother and more efficient execution of buy and sell orders.

In this complete guide to the volume-weighted moving average (VWAP) you’ll learn everything you need to know about the indicator. We’ll cover the formula, differences to other types of moving averages, and a couple of trading strategies that use the indicator.

Let’s begin!

What Is the Volume Weighted Average Price (VWAP)

WVAP is a moving average indicator that outputs the average price at which a security has traded so far during the day. In contrast to most other moving average indicators, WVAP uses not only price but also volume to come up with the indicator value.

This is a significant difference to regular moving averages, and means that the formula weighs each datapoint differently depending on the volume with which the bar was formed.

Another key difference to other moving average types is that the WVAP is reset at the beginning of each trading day, in order to only reflect the developments of the current day. This is why the indicator always makes a big jump at the beginning of each trading day, like in the chart below.

With the indicator resetting at the beginning of each trading day, the VWP becomes exclusively a day trading indicator. In fact, it won’t even show up on higher timeframes, like daily or weekly charts, since it needs intraday data to be calculated.

However, day traders are not the only market players that use the WVAP…

The Market Players That Use WVAP

SO, WVAP is not only useful for day traders, but also for bigger market players who want to sell or buy a large number of shares. Long term investors may also make some use of the indicator.

Let’s have a look at these two cases.

How institutional players use Volume Weighted Average Price

When large market players are looking to either buy or sell a large number of stocks, they cannot just dump their orders on the market. In most stocks, their sheer size would affect prices to their disadvantage.

For instance, a large buy order would drive prices higher, and the other way around.

Therefore, these institutions need to carefully assess the market impact of their orders before they decide to enter the market. This is also where WVAP comes into play, as a tool to distribute orders evenly in the market.

An existing strategy among these market players is to buy once the price goes below the WVAP, and sell once it goes above. That way they’re working actively to push prices towards the market average, rather than away from it, which otherwise could be an issue!

How long term investors use Volume Weighted Average Prices?

Long term investors sometimes use the WVAP as a tool to evaluate their entries to see whether they got in above or below the average price of the market that day. However, this is not that common, since most long term traders aren’t concerned with minor fluctuations anyways.

Later in the article, we’ll look much closer at how daytraders use the VWAP to find profitable entries.

How to Calculate WVAP?

You calculate WVAP by calculating the following steps for every bar:

1. You first have to calculate the typical price for the current bar. This is the sum of the low, close, and high, divided by three.

2. The second step is to multiply the typical price by the volume of the bar.

3. You take every value for every bar in the current trading day you got from the previous step, and add them cumulatively. To get the final WVAP value, you divide this value by the cumulative volume.

When you run the calculation on every bar, you’ll get a series of values that combined make up the volume-weighted average price, when plotted as a line.

Example

Let’s say that we have two bars at the beginning of a trading day. They have the following values:

______________

Bar 1

Open: 99

Close: 100

High: 101

Low: 98

Volume:100

_____________

Bar 2

Open: 100

Close: 101

High: 102

Low: 98

Volume:100

____________

Calculation

Here is how we would calculate VWAP for those two bars:

- We start by calculating the typical price for bar 1, which is (100+101+98)/3 = 99.7.

- Then we multiply the typical price by the volume and get 99.7*100= 9,700

- We repeat the above steps for the second bar and get 5017

- The last step is to divide the sum of the two values we’ve just calculated, which is 14,717 (5017 + 9,700) and divide it by the total volume of the period, which is 150 (100+50).

- The result of the calculation above, which is the WVAP value for the second bar, is 98.1.

Difference between VWAP and Moving VWAP

While VWAP is mostly an intraday indicator used predominantly by day traders or those who perform intraday operations, the moving volume weighted moving average is different.

The difference lies in that the latter does not reset by the end of each trading day, but is a plain volume-weighted moving average that’s calculated on the period set by the user.

Below we have plotted the moving VWAP by the side of the moving VWAP. As you can see, the WVAP makes big jumps as it resets by the end of each trading day, while the moving VWAP appears as a straight, consistent line.

As you may have expected, this trait makes the moving VWAP relevant also to traders who use trading styles that hold positions for longer periods of time, such as swing trading.

How To Use Volume Weighted Average Price in Trading

Having covered the basics of the indicator, let’s now move on to some more practical applications. We’ll look at some of the most common approaches involving the WVAP, to provide inspiration for your own trading. We’ll look at mean reversion as well as reversal trading and trend-following applications.

Just remember that you can never know if the concepts presented are going to work well with your particular market. Therefore it’s crucial that you always validate your ideas and assumptions before trading a real account.

If you’re unsure about how to validate a trading strategy, we recommend that you either look at our guide to backtesting, or our article explaining how to build a trading strategy.

That said, let’s explore the most common applications of the WVAP in trading!

Mean Reversion Trading

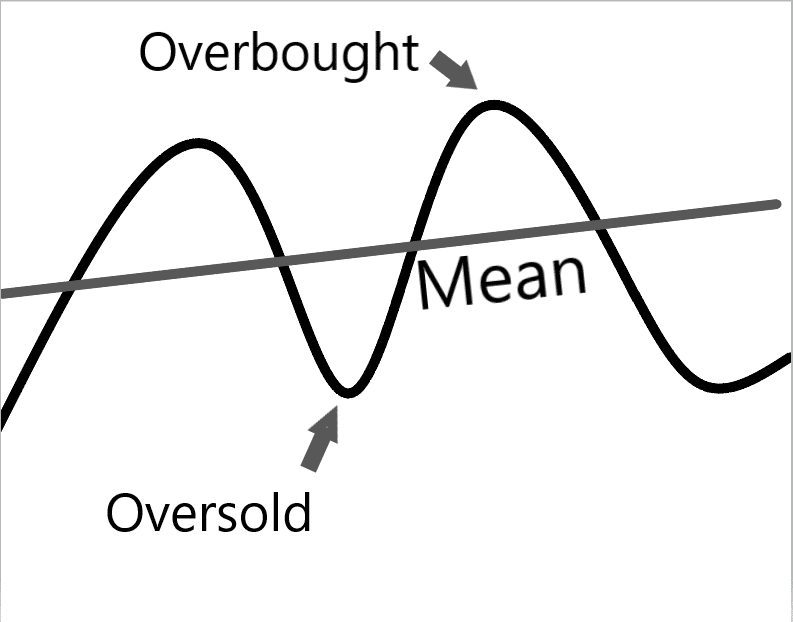

Mean reversion is one of the two most common trading strategy styles used by traders today. It works by identifying when a market has fallen too much and soon is about to revert to its mean, or average.

Typically traders say that a market is overbought once it has risen too much, and oversold when it has fallen too much and become “cheap” in many market participant’s view.

So, when trading price reversals or mean reversion with the VWAP indicator, we attempt to catch short term overbought or oversold signals. This means that we wait for those times when the market has moved a large distance away from the VWAP, and is likely to bounce back.

I the image below you see how a stock moved down quite a bit, which made the security trade at a significant distance from the WVAP indicator. This presented a nice buying opportunity, as the market indeed did move up shortly thereafter.

The distance that the market must move below the VWAP line could simply be defined as a percentage distance, or as a multiple of average true range.

Won’t the market just continue to fall most of the times?

Now you might wonder how to know when a stock has fallen enough. Many times markets issue signals like the one above, just to continue falling shortly thereafter.

Well, that’s true, and you won’t get very far only acting on the above signal.

Let’s look at some techniques you may use to create something tradable!

How to Improve Mean Reversion Systems

In order to improve a mean reversion strategy, we first need to understand how mean reversion systems work and react in different market conditions. Here are the main points you need to know about:

1. Mean Reversion edges get better the more the market has fallen

The edge of any mean reversion strategy lies in that the market has overextended itself to either side. Thus, the more a market has fallen, the more prone it’s to soon go up.

This is something we may utilize in our strategies, by using conditions that demand that the market has gotten really oversold. We’ll have a look at conditions like these in just a bit!

2. Trades will go against you

With the mean-reverting approach, we’re catching “falling knives” in anticipation of a market reversal. This means that the market will continue down past our entry point in most cases, before it turns up again.

Sometimes a market could fall a great distance before turning up again, meaning that you’ll have to make sure not to place your stops too close to the entry. Otherwise, you’ll get stopped out all the time, before the market has had a chance to turn around.

So, knowing that trades will go in the opposite direction of your entries is essential to be able to cope with trading any mean reversion system.

3. Mean reversion systems often fail abruptly (once they do)

Since most mean reversion systems experience quite big swings within each trade, meaning that they first go down and then recover, they tend to fail quite abruptly once they do. That’s not too strange, considering that we allow these strategies to be in quite large intra-trade drawdowns which could backfire quite intensely if the security never initiates a reversion to the mean.

Despite this fact, mean reversion strategies should not be overlooked! They’re great and tend to work quite well, especially on the daily timeframe, which by the way would require that you use the moving VWAP instead.. We’ll come back to this in a later section of the article that specifically deals with the MVWAP.

Techniques to improve Mean Reversion Strategies with WVAP

Here follow some techniques to identify when an oversold signal might be worth acting on:

1. Imposing additional oversold criteria.

One of the most common ways to improve mean reversion systems is to simply add additional criteria which define the oversold state of the market. Here are some examples of what you could do:

- Demand that the market trades below the low of the previous day

- Use oscillators like the RSI indicator, and demand low, oversold readings.

- Use a price channel like Bollinger bands and demand that the close is below the lower band.

2. Get the bigger picture

When using the VWAP, you’re mostly focused on small, minute based timeframes. This means that you may miss out on the complete market picture, and how the market works on the higher timeframes.

That’s why it often is beneficial to make use of a higher timeframe, like the daily timeframe, to get the bigger picture. For instance, you may not want to take a mean reversion signal if the daily timeframe is getting overbought and shows signs of weakness. Conversely, you may be more inclined to act on a signal if the daily timeframe trades on oversold levels.

You may also apply the filters from point 1 to the higher timeframe.

Remember that price action on higher timeframes nearly always is more significant than price action on the lower timeframes. Thus, for most strategies, it’s wise to make a habit of checking in on the daily timeframe before placing a trade.

Price Reversal

A quite common approach to most types of moving averages is to look for moving averages crossovers to define price reversals in the market.

A moving average crossover is when a shorter average, like the 20- period average, crosses over a longer average, such as the 50-period average. This signals that the short term trend has turned around and that the market is likely to reverse into a new market trend.

And as you may have guessed some traders choose to also use crossovers together with VWAP.

However, since the VWAP calculation is reset each trading day, we need to use the moving VWAP instead, as we’ll need one slower and one faster average. This cannot be accomplished with a plain WVAP, since it always bases its length on the distance to the market open.

Here follow some of the most commonly used rules to identify price reversals with the moving VWAP:

Settings:

Short Moving WVAP: 20 periods

Long Moving WVAP: 5 periods

Rules to go long:

- The market is oversold, defined as recently having touched the lower band of a price channel indicator

- The fast Moving WVAP line crosses above the Slow Moving VWAP line

Rules to go short:

- The fast Moving WVAP line crosses below the slow Moving WVAP line.

- The market comes from the upper price channel band. Thus, it comes from an overbought level.

Rules to exit the trade

One popular approach is to exit the trade as soon as we get an MWVAP crossover in the opposite direction of the crossover signal.

Below is an example of a long trade that was entered based on these very rules.

Trend Following Strategies

Together with mean reversion, trend following indeed is one of the most popular trading styles out there. Many of the famous traders throughout the years have used this approach to consistently make money in the markets.

Trend following simply means that you buy on market strength since you believe that the market is strong enough to continue in the direction of the momentum.

Now, while trend following usually is applied to the daily timeframe in position or swing trading strategies, it could be applied to lower timeframes as well.

Day traders who use trend following strategies together with the VWAP often look for a positively sloping indicator line, coupled with another indicator signal to go long.

This “other indicator signal” should be of a kind that signals market strength, such as a high RSI reading, or a breakout above a previous high. In the example below, we’ll use an RSI reading of more than 90, coupled with an ADX reading of more than 30, to make sure that the market is in strong shape and likely to continue in the direction of the momentum.

So, the rules for this strategy are as follows:

To go long:

- VWAP is sloping upwards

- 5 – period RSI is above 90, and the 14 period RSI is above 30

To go short:

- VWAP is sloping downwards

- The 5 – period RSI is above 90, and the 14-period RSI is above 30.

Usually, you exit a trade as soon as the market closes clearly below the VWAP if you’re long, or once it closes above if you’re short.

Example

Below you see an example where the strategy conditions above are met for the long side:

Trading the Moving VWAP

As we touched on earlier, the Moving VWAP simply is a volume-weighted moving average, which doesn’t reset by the end of the day like the VWAP.

This means that it behaves roughly like other moving average indicators, with the only difference being that it will produce somewhat different indicator readings than a regular moving average.

Due to this, we won’t go very deep into how to use the VWAP in this article. Instead, for those who wish to learn we refer to our extensive guide to moving averages, which covers concepts that are universally applicable to most moving average indicators.

Conclusion

Before ending, we just wanted to touch on one very important topic.

The strategies and methods laid out in this article mirror commonly used methods and approaches that exist today.

However, this does not mean that they are profitable per se. You always have to test your assumptions on historical data, to see that your trading models hold up before you risk any real money. If you don’t know what we’re talking about, we urge you to read our article on how to build a trading strategy, or how to backtest a strategy. It will save you a lot of valuable time, and money, in the long run! And yes, we know that Volume Weighted Average Price should be written VWAP and not WVAP…

FAQ

How does VWAP benefit day traders?

VWAP is valuable for day traders as it helps them assess the average price at which a security has traded during the day, considering both volume and price. Day traders often use VWAP to make informed decisions about entering or exiting positions based on intraday market developments.

How do institutional players use VWAP in trading?

Institutional players use VWAP to carefully assess the market impact of their large orders. By buying when the price goes below VWAP and selling when it goes above, institutions actively work to distribute orders evenly in the market, avoiding adverse price movements due to their large trades.

How can VWAP be used for mean reversion trading?

Mean reversion trading with VWAP involves identifying when the market is oversold or overbought. Traders wait for the market to move a significant distance from VWAP and then anticipate a reversal. Additional criteria, such as the market trading below the previous day’s low, can enhance mean reversion strategies.