Definition

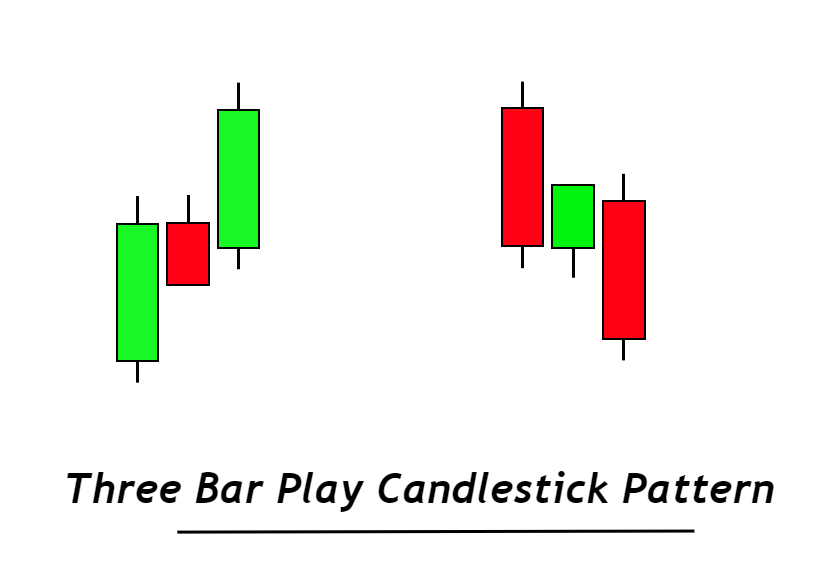

The Three bar play is a trend continuation candlestick pattern that consists of three candlesticks. It forecasts that the previous trend will continue in the market.

Retail traders use this three bar play candlestick pattern to determine the upcoming direction of the trend. Then they trade with the primary trend to extract profits from the market. Trading with the trend is the key to success instead of trading against market makers, which will always make you lose in trading.

In this post, you’ll learn a detailed guide to three bar play candlestick patterns and a day trading strategy to trade with three bar play patterns. So make sure to read the full post.

How to identify the three bar play pattern?

A three bar play candlestick pattern consists of three candlesticks. Two big bullish candlesticks and a small candlestick make a three bar play pattern. The small candlestick constantly forms between the other two big candlesticks.

Types of 3 bar play

There are two types of this candlestick patterns based on trend direction and candlesticks.

- Bearish three bar play pattern

- Bullish three bar play pattern

Bullish three bar play

During the bullish trend rising/bullish 3 bar play candlestick pattern forms. It consists of two big bullish candlesticks with a small pullback candlestick. The small pullback candlestick form within the other two candlesticks.

it shows that the bullish trend will continue in the market.

Bearish three bar play

A falling/bearish three bar play pattern forms during the bearish trend. It consists of two big bearish candlesticks with a small pullback candlestick.

it represents that the bearish trend will continue in the market.

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

Get Access to Course

Rules to find bullish and bearish three bar play candlestick

You should follow three rules to filter out the best patterns from the chart.

- The first and third candlesticks should have at least a 60% body-to-wick ratio. It should also have the same color. For example, in bearish trends, both candlesticks should have red, while in bullish trends, both candlesticks should have green.

- The inside candlestick within the big candlesticks represents a price pullback. It will be a small candlestick compared to the other two big candlesticks.

- The three bar play pattern should always form at a significant key level.

What does the three bar pattern tell traders?

Forecasting the market maker’s activity behind the chart using price action will make you a winning trader.

Because decision-making is the most important, and if you make decisions without a solid reason, then chances of loss in trading will increase. However, the chances of loss will decrease when you make decisions by analyzing the trader’s activity behind the chart. So trading is about increasing the probability of winning by adding different factors.

Let’s break down the structure

The first significant bullish candlestick form at a certain key level shows that buyers are in complete control and have broken a major key level made by sellers on their way. Now, after the breakout, retail traders will try to sell from the resistance level then the price will give a small pullback that will show that the price is going down. Now a greater number of retail sellers will come to the market. But in reality, this was a market-maker trap to capture more traders and increase volatility.

Then market makers will come into the market again, and a big bullish candlestick will form, showing that the market makers are in a bullish trend, and the upcoming trend will also be bullish.

So, if you trade with the bullish trend, you’ll also make profits; however, if you trade like a retail trader, you’ll lose most of the time.

Similarly, a bearish pattern will form when market makers are on the side of the bearish trend.

How to trade three bar play candlestick patterns?

This trading strategy consists of breakout, pullback, and continuation price patterns. We will open trade after a pullback and hold the trade until the trend continues.

Open Sell stop order

When a big bearish candlestick forms at a major key level in the form of a breakout candlestick, then after a breakout candlestick, the price will give a pullback in the form of a small candlestick.

Open a sell stop order below the low of a small candlestick. Order will be filled automatically when the price trend continues. Then, after 3 bar play pattern, candlestick confirmation keeps holding the trade until trend reversal. Otherwise, if a third bearish candlestick does not form, close the trade.

Open a buy-stop order

When a big bullish candlestick breaks a strong key level, the price will give a small pullback in the form of a small candlestick. Then open a buy stop order above the high of the small candlestick.

If the third candlestick does not have a big bullish body or does not meet the criteria of three bar play, then close the order and look for another opportunity. Otherwise, hold the trade until a major trend reversal.

Tip: if small candlestick forms within the range of the previous big candlestick, you should choose the high/low of big candlestick instead of the smaller one.

The bottom line

Candlestick patterns are building blocks of technical analysis in trading. These price patterns have many things hidden within the price structure. You will explore if you will use a pattern again and again. This is the price action that you’ll learn with screen time.