China's biggest borrowers

In 2013, China’s President Xi Jinping launched the Belt and Road Initiative (BRI). Originally set to be a massive programme of investments in infrastructure developmentthat would ultimately linkAsia to Europe, the plan later expanded around the globe, particularlyin developing countries.

A decade on, China is now the world’s largest official debt collector –and the number ofoverdue payments it's owedis soaring at a time when Beijing is grappling with its own financial issues. Research organisation AidData estimates that as much as 80% of China’s overseas lending portfolio currently supports countries in financial distress, with the total it's owedreaching more than $1 trillion (£790bn).

ADVERTIsem*nT

Read onto discover the 30 countriesmost heavilyin debt to Chinaand find out who’s struggling to make payments.

Debt figuresare via AidData andaccount for total debt from 2000 to 2021. All dollar amounts in US dollars.

Belarus: $11 billion (£9bn) total debt

Many of the loans issued by China during the BRI lending spree have targeted big-ticket infrastructure projectswhile lacking appropriate risk management practices tohelp ensure repayment.

One example of this was theissuing of dollar and euro-denominated loans to countries like Belarus, which wouldgo on to face international sanctions preventingthem from carrying out transactions in those currencies.

The eastern European country now owes China $11billion (£9bn). Much of this money has been invested in logistics and manufacturing, including the Great Stone Industrial Park, which has attracted Chinese firms with tax incentives.

Turkmenistan: $12.2 billion (£10bn) total debt

China has also loaned large sums of money to Turkmenistan,which islocatedin Central Asia and known for its abundant gas and oil deposits.

China paid for around 4,000 miles (6,430km) of pipeline infrastructure to bring natural gas from Turkmenistan across the continent to its western Xinjiang province. The project reached completion in 2009, and Turkmenistan government officials reportedthey'd paid offthe pipeline in full as of 2021. However, the exact cost has never been released to the public,with estimates ranging from $8 billion to $10 billion (£6bn-£8bn).

Kenya: $12.7 billion (£10.2bn) total debt

Kenya borrowed around $5 billion (£4bn)for the construction of its Mombasa-Nairobi Standard Gauge Railway project, which opened to passengers in 2017 and is widely considereda success as it's helped cut journey times in half.

However, some critics have pointed out the environmental and social impacts of the railway, which cutsthrough Nairobi National Park, while othersare dubious of itstight repayment schedule. The plan also initially called for a segment of the railway to connectto neighbouring Uganda, although this later gotscrapped. Without the option for cross-border trade, the railway could prove to be financially unsustainable.

In October 2023, it was announced that Kenya’s President William Ruto would ask China for the option to repay the rail loan at a slower pace. He was alsoreportedly planning to request an additional$1 billion (£790m) in loans for upcoming road projects.

As of 2021, the EastAfrican nation owes China $12.7 billion (£10.2bn).AP reports thatthe government has been withholding civil servant paycheques in a bid to save money to pay back its foreign loans.

Democratic Republic of the Congo: $13.1 billion (£10.5bn) total debt

The Democratic Republic of the Congo (DRC) is thought to have racked up debts of more than $13 billion (£10.5bn) to China over the last two decades, much of which is related to mining and infrastructure investments.

As part of its BRI loan, DRC isone of many countries that, according to the AidData report, is required to"keep a minimum cash balance equivalent to 20% of its total outstanding debt under multiple China Eximbank loan agreements in an offshore, lender-controlled escrow account".

In periods of economic downturn or financial distress, meeting these requirements is increasingly difficult for borrowers, stifling potential economic growth that could otherwise help to pay back the loans and resulting ina never-ending cycle. At the same time, other lenders are hesitant to offer bailouts because the escrow accounts place China first in line for payment should the country default on its loans. As a result, many critics have referred to the BRI as a "debt trap".

Earlier this year, it was reported that foreign cash reserves had dropped by more than 50% in the DRC, amid fears it’s only a matter of time before the impoverished nation runs out of money for essential imports such as food and fuel.

Zambia: $13.5 billion (£11bn) total debt

It’s a similar situation in Zambia, which has borrowed $13.5 billion (£11bn) to build its roads, railways, and dams.

However, debt maintenance to China ate up such a significant portion of the country’s tax revenues that it defaulted on its loans. Inflation has since skyrocketed by 50% and the local currency has lost 30% of its value. Unemployment is at record highs and an estimate fromthe United Nations suggests that around 3.5 million citizens are unable to afford food. For context, Worldometer suggests the country's current population size is close to 20 million.

Myanmar: $13.7 billion (£11bn) total debt

Facing sanctions from many of the world’s prominent lenders due to human rights violations, Myanmar has relied on China as its main source of investment for years. The most recent series of funding, agreed in 2018, includes money fora copper mine, a railway project, and a deep-sea port, many of which are opposed by local residents.

During a February 2021 coup that sent the southeast Asian nation into a period of political instability, anti-China sentiment was widely observed, with many Chinese factories destroyed.

However, since the coup Myanmar has resumed many of itspreviously planned projects. It's alsoreached out to other countries, such as Singapore and India, to reduce its reliance on China.

Nigeria: $14.5 billion (£11.7bn) total debt

Nigeria has borrowed $14.5 billion (£12bn) as of 2021.

Facing economic distress, the west African country is taking out separate emergency loans from Beijing, which is reportedly charging higher interest rates of around 5%, compared to the 2%typically chargedby the International Monetary Fund (IMF).

Billions of Chinese dollars have been poured into everything from theLekki Deep Sea Portto railway lines, airports, and Lagos’s first metro line (pictured).

Egypt: $15 billion (£12bn) total debt

Chinese construction firms have built much of Egypt’s recent infrastructure, including power plants and the New Administrative Capital (NAC).Located 27 miles (45km) east of Cairohome, it will be the home of government offices and, eventually, more than five million residents.

Home to the Iconic Tower, the tallest building in Africa, this new, as yet unnamed city is largely unoccupied and often criticised for being a vanity project. China helped financethe project, which is anticipated to cost $40 billion (£32bn) in total.

With the Egyptian economy struggling so severely in 2022 thata gold-buying frenzy was triggered, the government sought loans and aid packages from the IMF, the United Arab Emirates, and Saudi Arabia. In October 2023,it signed a debt swap agreement with China for yet more development projects.

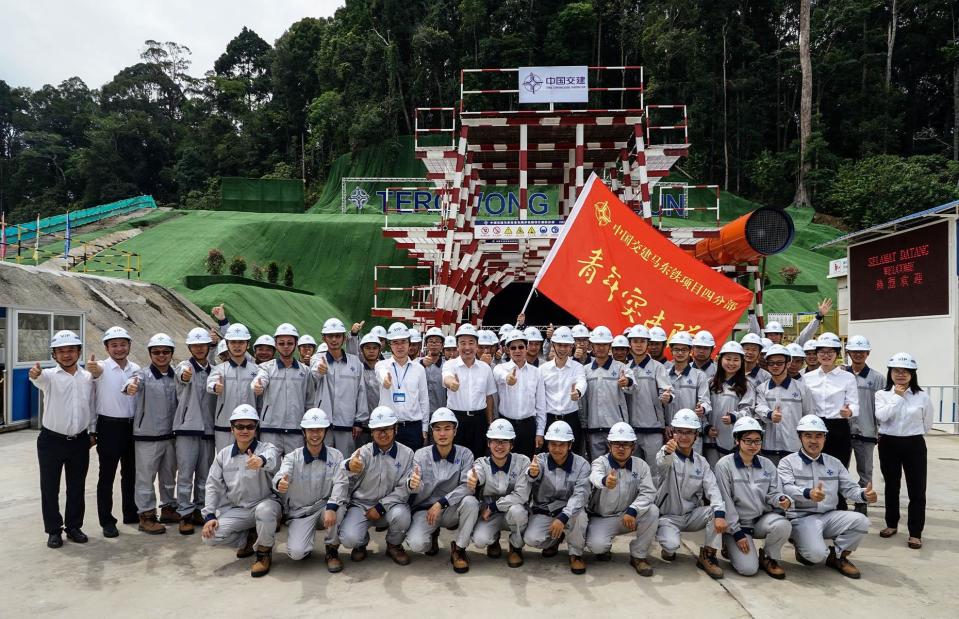

Malaysia: $15.9 billion (£12.8bn) total debt

Of all the countries participating in the BRI, Malaysia has seen some of the most extensive projects in terms of ambition, including its400-mile (640km) East Coast Rail Link.

Despite this, Malaysia has managed to avoid much of the "debttrap" that other countries on thelist are facing, largely because the projects are more likely to have been initiated bylocal stakeholdersrather than by Beijing.

Unfortunately, a lack of due diligence from Chinese investors has meant that building Malaysian infrastructure is far fromsmooth sailing. Embezzlement, legal problems, and schedule delays have all plagued projects.

Cambodia: $16.3 billion (£13.1bn) total debt

Cambodia is one of the many countries whose debt to China exceeds 20% of its nominal GDP.

While some political scientists worry this over-reliance on China could leave Cambodia vulnerable to the debt trap effect seen elsewhere,others are more concerned about the quality of the infrastructure being built, as well as the over-hyped promises that politicians are making about the benefits of the BRI.

However, one of the biggest Chinese investment projects in Cambodia,the Sihanoukville Special Economic Zone,has been largely deemed a success. It includes hundreds of factories and other infrastructure, including billion-dollar road projects to connect the zone to the nearby port city of Sihanoukville.

Peru: $16.9 billion (£13.6bn) total debt

While the BRI initially targeted the Eurasia region, China has expanded its reach across the globe by lending money to countries like Peru, which now owes China $16.9 billion (£13.6bn).

China is the leading investor in the South American nation, particularly in the mining sector. As Peru’s raw materials are in high demand in China, it diversified its investments to include port infrastructure, with Chinese firms building a mega port project in the city ofChancay.

As of 2020, China has ended state loans to Latin American governments. In a report from May 2022, news siteVOAnoted the nationis now focusing on private financing earmarked for mining and energy projects with a Chinese element to them, for fear that borrowers were becoming too heavily indebted.

Sudan: $18 billion (£14.3bn) total debt

China has long invested in Sudan's agriculture, transport, and energy sectors, with someestimates suggestingas much as $3 billion (£2bn) has goneinto developing oil fields and pipelines to Port Sudan.

Facing economic sanctions from the West,the North African nation had been unable to pay off loans issued in the dollar and euro denominations. The Sudanese governmenthas previously revealed it owed $127 million (£101m) of penalty interest to its Chinese creditors as of March 2022.

This ever-mounting debt is in further jeopardy, withcivilians fleeing Sudan after violence and political instability escalated into a civil war.

Uzbekistan, $18 billion (£14.3bn) total debt

Due to its ample natural gas reserves, energy has been a priority sector for China when it comes to Uzbekistan. One of its biggest schemes in the Eurasian nation is the Oltin Yo’l GTL (gas-to-liquid) processing plant, which opened in 2021 and cost $3.4 billion (£2.7bn) to build.

Chinese firms have also funded textile and ceramic factories, which are targeted to local consumers and importers in China.

Transport and logistics infrastructure has also been improved to facilitatethis new trade. However, the flurry ofdevelopment comes with a cost, and over the last two decadesUzbekistan has built up a total debt of $18 billion (£14.3bn).

Sri Lanka: $19.5 billion (£15.5bn) total debt

Along with Zambia, Sri Lanka has defaulted on its loans from China, reaching a point in spring 2022 where it was unable to even make interest payments on the debt.

Since then, the country has faced its worst economic crisis ever, with hundreds of thousands of people losingtheir jobs, inflation running rampant(even hitting 50%), and much of the population falling into poverty. Tax increases have triggered extensive protests across all sectors,from doctors and university professors to port and petroleum extraction workers.

While the IMF agreed to provide Sri Lanka with a bailout earlier this year, it's unclear if it willqualify for the next round of payments. Like several others, the south Asian nation has relied on China for emergency loans, which come with fewer strings attached but higher interest rates.

Bangladesh: $20 billion (£16bn) total debt

The BRI covers so much more than just trade and infrastructure: it's also meant to endear the developing world to China and "[broadcast] positive messages about its overseas activities", to quote AidData.

This certainly seems to bethe case for investments in Bangladesh. As China’s public perception has improved, it's ratcheted up its annual financial commitment to the nation from $994 million (£791m) at the start of the programme to nearly $3.5 billion (£3bn) by the start of this decade.

The money flowing into Bangladesh has had a beneficial impact, from helping reduce poverty to developing major infrastructure works, such as power plants and bridges. Around the same time, China overtook itsneighbourIndia as Bangladesh's largest trading partner. It’s no surprise that goodwill toward Beijing has been on the rise.

Ethiopia: $20.4 billion (£16.3bn) total debt

When it comes to funding and building infrastructure, Ethiopian officials have reported a preference for working with China over other sources of support,such as the World Bank. Acknowledging that these loans are more expensive, they still favourthe speed and ease of working with Beijing.

Chinese firms have scooped up the contracts for multi-phase projects, including the Addis-Africa International Convention and Exhibition Center (AAICEC). Construction on the AAICEC began in 2017 and isongoing.

However, Ethiopia hasbeen forced to seek debt relief from China and other creditors. Aswith other countries on this list that arestruggling to pay back their debts to China, Ethiopia’s foreign cash reserves, which it uses to buy essentials like fuel and food, are running dangerously low.

Laos: $20.6 billion (£16.4bn) total debt

A World Bank investigation into Chinese lending uncoveredhundreds of loans that had been kept off the books. As countries took advantage of the BRI financing to develop much-needed infrastructure, they quickly became heavily indebted, resulting in fears thatcredit rating agencies would see the addition of more debt as problematic.

As a workaround, China created shell companies for many major infrastructure projects in places like Laos, allowing borrowers to amass private debt, even if backed by the government.

The results of the investigation showed a whopping $385 billion (£307bn) of hidden or underreported Chinese debt across 88 countries, many of which are in dire straits. In Laos, for example, a railway system was financed bya $3.5 billion (£3bn) loan, which researchers say would take around 25% of the country’s annual output to pay off.

South Africa: $21.3 billion (£17bn) total debt

South Africa is one of the largest borrowers on the continent, with itstotal debt from the last two decades reaching around $21.3 billion (£17bn).

Despite this, it's not one of the many countries that are struggling to cope with their Chinese debt. Researchers suggest this may be because South Africa already had good trade and logistics conditions established prior to the BRI, meaning any investment in new infrastructure was more likely to offer a higher return, better enabling the government to service the debt.

Researchers have also highlighted that South Africa had fewer Chinese workers during the programme compared to other countries.

Ecuador: $26.3 billion (£21bn) total debt

Much of Ecuador’s debt is tied to contracts for crude oil – and the conditions of these loans are far fromfavourable. Following Chinese investments in mining andother infrastructure, the Ecuadorian governmentowes as many as 160 million barrels of oil to help repay loans. Last year, it restructured its debt with China, allowing Ecuador to sell more oil to the market.

The US is aware of the multi-prong impact of China’s loans, namelyincreased access to precious minerals and other resourcesand the economic distressplaguing many otherborrowers. In 2021, the US struck a $2.8 billion (£2.2bn) deal with Ecuador to help the South American nation repay some of its debtto China"in exchange for excluding Chinese groups from the country’s telecoms networks", according to theFinancial Times.

Iran: $28 billion (£22.3bn) total debt

The AidData team reports that Iran has acquireda total debt of $28 billion (£22.3bn) over the last 20 years. However, very little of that is publicly acknowledgedorrelated tothe BRI.

Over the last decade, China reportedly provided$350 million (£272m) toward a steel project in Iran, as well as $2.3 billion (£1.8bn) for a passenger rail line connecting Qom and Esfahan.

Critics say the new railway isn't economically justifiable, while other Iranianrail projects more likely to generate revenue are reportedly unfinished. In addition, this work relies mainly on Chinese labour and materials, leaving little for Iran to profit from.

Türkiye: $28.3 billion (£22.5bn) total debt

Türkiye and China havelong collaboratedon infrastructure development, with the transport and energy sectors dominatingtheir mutual agenda after BRI launched in 2013.

Fast forward to 2023, and Türkiye and China are spearheading a massive scheme to create a trade route that will connect countries in Central Asia and the Caucasus. The idea for a "Middle Corridor",which would include Azerbaijan, Georgia,and Kazakhstan, has been under discussion for decades, with the conversationreignited again recently in the hope of capitalisingon international interest in an alternative trade route that can avoidRussia.

While Türkiye is among the top 10 countries with the most Chinese debt according to AidData, it has seemingly enjoyed a better result from the BRI programme compared to many other nations on this list.

Vietnam: $28.8 billion (£23bn) total debt

In 2017, AidData estimated that Vietnam owed more than $16 billion (£13bn) just for project financing on construction works, including the Cat Linh-Ha Dong tramline.

As the total debt mounted, the nation looked to decouple from China’s influence, put off by the high rates of interest and some of the less favourable conditions, including the use of Chinese labour. No new projectsofficially tied with the BRI have been announced since.

Vietnam is thought to have avoided the Chinese debt trap, comfortably repaying its loans. However, the nation is quickly growing wealthier, and infrastructure is essential to maintain this development, while local capital is increasingly in short supply.

Argentina: $37.7 billion (£30bn) total debt

China has historicallysent funding to Argentina, but it wasn’t until the BRI launched thatthe money really started flowing, bankrolling everything frompower plants and irrigation systems to highways, railways, and even a space monitoring station. When Argentina entered a recession and defaulted on loans in 2014, Beijing stepped in with debt swaps to help secure the economy withoutWestern intervention.

This generosity comes with serious strings attached, withthe resultingcost of fees and credit insurancean issue for many countries on this list. For Argentina, it meant a $4.7 billion (£4bn) loan fromChinese banks to construct a hydroelectricplantcame with a 1.5% fee for defaulting, plus an insurance policy from Chinese company Sinosure that's worth a whopping 7% of the loan, or $503 million (£398m).

Accumulating a total debt of $37.7 billion (£30bn) over the last 20 years and in the midst of an economic crisis, Argentina is struggling to service its debts and continues to reach out to China for bailouts.

Brazil: $54.3 billion (£43bn) total debt

Across South America, Brazil is easily the largest recipient of BRI funding and holds the most total debt to China. Chinese companies have poured money into the nation's electricity industry– nearly half of the funding is earmarked for projects in this sector – while oil and mining have also seen significant investments.

US officials have warned Latin America of the debt trap that's been causingeconomic crises around the globe, while former Brazilian President Jair Bolsonaro has vocally opposed Chinese influence. However,Brazil hasgone on toinitiate even more trade ties with China.

Indonesia: $55 billion (£46bn) total debt

Like Vietnam, Indonesia's $4 billion (£3.2bn) loanfor a high-speed rail infrastructure programme had previouslybeen hidden away from public accounts. All was revealed when the construction work exceeded budget by a further$1.5 billion (£1.2bn), and the Indonesian government hadto use state funds to bail out the railroad.

In April 2023, it took out a loanto the tune of $560 million (£443bn) from China Development Bank, ensuringthe railway couldlaunch in October. Researchers have raised concerns that this project is an example of Indonesia falling victim to the debt trap seen in other countries, especially consideringthe southeast Asian country now has an estimated total debt to China of $55 billion (£46bn).

Kazakhstan: $64.2 billion (£51bn) total debt

The relationship between Beijing and Kazakhstan has been rocky over the last 20 years, during which time thelatter hasbuilt up a total debt of $64.2 billion (£51bn). And as Kazakhstan has struggled to repay its loans, China has taken a larger share in the country’s oil industry. During one economic crisis, for example, China provided $5 billion (£4bn) of funding, allocating around $3.5 billion (£3bn) to go toward clearing its debt for equipment purchased from China.

However tense the relationship, Kazakhstan continues to partner with China to expand rail capacity in its shared border regions, with a new rail bypass megaprojectunderway in 2023.

Angola: $64.8 billion (£52 billion) total debt

One of the big risks China has takenis bankingon countries being able to repay their loans withcash proceeds from natural resource exports, as has been the case in oil-rich Angola. In 2015, China Development Bank gave a $15 billion (£12bn) loan that required the Angolan government to keep a minimum balance of $1.5 billion (£1.2bn) in an escrow account as collateral. However, when oil prices fell, the government could no longer service the debt.

China agreed to reschedule the loan, deferring most of the payment while using the escrow moneyto cover the interest. Calculating that most of the cash would be gone within a few years, it demanded Angola provide another $1.5 billion (£1.2bn) by 2023.

Pakistan: $68.9 billion (£55bn) total debt

Pakistan has previously benefitted from the BRI programme, having seen the creation of 200,000 jobs and 900 miles (1,400km) of roads, as well as the expansion ofports and boosting of electricity to the national grid. However, most of the investments that made these infrastructure accomplishments possible came from loans at or near commercial rates.

Now foreign debt is crippling Pakistan and its cash reserves are nearly depleted. The result? Crippling economic distress, which has destroyed millions ofjobs and plunged people into poverty. The nation also relies on high interest emergency loans from China, whose state-owned banks fear the economic impact of countries like Pakistan defaulting on their debt.

Venezuela: $112.8 billion (£90bn) total debt

In Venezuela, China has gambled big on loans for oil where repayment could be made in the form of oil exports if the borrower defaults. The loans included a financial agreement to lend money, as well as a commercial agreement for Chinese importers to purchase oil from Venezuela’s state-owned oil and natural gas companyPDVSA, which also forms collateral for the financial deal.

Following the impactof the financial crisis on the oil industry, China and Venezuela found themselves in a catch-22. Oil proceeds increasingly went to Chinarather than being reinvested in PDVSA, which then struggled to finance operations. This in turn jeopardised its production and, ultimately, Venezuela’s ability to repay the debts. Analysts from the Wilson Center at the Kissinger Institutehave suggested that instead ofcreating a debt trap, China hasbecome "ensnarled in a creditor trap" in Venezuela.

Russia, $169.3 billion (£134bn) total debt

The largest recipient of funds in the BRI programme, Russia is by far the biggest borrower from China, racking up a total debt of $169.3 billion (£134bn) over the last 20 years. However, AidData's figures onlyaccount for borrowing that took place between 2000 and 2021 and, realistically,this figure is likely to be even higher following Russia’s invasion of Ukraine.

Facing western sanctions, Moscow has turned to Beijing to secure serious sums of money, with China’s four biggest banks reported to have quadrupled their exposure to Russia's banking sector since February 2022. Projects using BRI funds are still ongoing in Russia, with local officials reporting new investments worth as much as $1.6 billion (£1.3bn) in 2022 in the Khabarovsk Krai region alone. This includes infrastructure to build the Russian Pacific Railway, a project that's designed to expand capacity along the Trans-Siberian railway north into theArctic.

Now discover which countries have the highest cost of living right now