The strong year-to-date gains in the stock market are impossible to deny, but August’s losses serve as a reminder that investors need to have a cautionary plan for tougher times. Furthermore, according to strategists from JPMorgan and Wells Fargo, these challenging times may be closer than we think.

The gains have largely been powered by the AI boom in tech – and that has led to an unstable situation, with rising stock indexes resting on a narrow base. According to JPMorgan’s Chief Global Market Strategist Marko Kolanovic, the narrow base supporting the S&P gains is a strong indicator of a bubble on the verge of bursting. “We remain of the view that the delayed impact of the global interest rate shock, steady erosion of consumer savings and post-COVID pent-up demand, and deeply troubling global geopolitical context will result in market declines and re-emergence of market volatility,” Kolanovic opined.

Weighing in from Wells Fargo, global market strategist Scott Wren believes that the pace of inflation, which has moderated recently, could start accelerating again – and create additional pressure on the economy. “If inflation’s descent flattens out,” Wren says, “and reverses as interest rates rise higher, we believe the sectors that have driven this rally should be vulnerable to sharp pullbacks.”

This isn’t to say that investors should stay out of stocks, but it is a situation that lends itself to taking a ‘preemptively defensive’ stance, and finding positions that will offer protection from a turn down. High-yield dividend stocks come immediately to mind. These stocks, offer steady passive income streams at inflation-beating levels, for a certain return should markets turn south.

With this in mind, we’ve used theTipRanks databaseto pinpoint two stocks that match a solid defensive profile: a Buy rating from the analyst’s collective wisdom and up to 8% dividend yield. Let’s take a closer look.

Kinetik Holdings (KNTK)

We’ll start in the energy sector, where Kinetik bills itself as a ‘pure-play Permian midstream provider,’ that is, an operator involved in moving hydrocarbon and ancillary products from the production fields to the customers. The Permian formation, in Texas, and particularly the Delaware Basin area of it, is one of the world’s fasted growing regions for oil and gas development. Kinetik provides a range of gathering, compression, processing, transportation, and water management services.

Kinetik’s network includes 4 cryogenic processing plants, and more than 1,700 miles of pipeline in its footprint area. The company’s systems can handle crude oil, natural gas, natural gas liquids, and produced water; the pipeline network features redundancy and reliability, and was designed to accommodate expansion activities.

The oil price decline during the first half of 2023 had a noticeable impact on the company’s second-quarter financial results. The company’s revenue stood at $296.2 million, marking a 16.7% year-over-year decrease and falling short of projections by $28.06 million. On the positive side, the company’s EPS of $0.41 beat the estimates by 3 cents per share.

Of interest to dividend investors, Kinetik had $126.7 million in distributable cash flow, a non-GAAP measure that typically supports the dividend payment. The company made its most recent dividend declaration on July 20, for Q2, and set the payment at 75 cents per common share. At this rate, the dividend annualizes to $3 and gives a forward yield of 8.62%.

Covering this stock for Jones Research, analyst Eduardo Seda puts an emphasis on Kinetik’s ability to ensure capital returns, noting, “Since its formation, KNTK’s primary objective has been to increase shareholder value by continuing to provide stable and sustainable cash dividends over time while ensuring the ongoing stability and growth of its business.”

“We believe KNTK’s structured contracts enhance the stability of the company’s revenue, gross margin, and cash flow generation, and to a greater extent, dividend coverage protection as dividend growth is based on long-term sustainability,” the analyst added.

Along with these comments, Seda gives KNTK shares a Buy rating with a $43 price target indicating his confidence in a 23% potential upside for the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~32% potential total return profile. (To watch Seda’s track record, click here)

Overall, there are 4 recent analyst reviews on file for Kinetik’s stock, and they break down 3 to 1 favoring Buys over Holds, for a Strong Buy consensus rating. The shares are priced at $34.92, and their $39 price target implies ~12% upside on the one-year horizon. (See KNTK stock forecast)

Crown Castle (CCI)

Switching gears, we’lllook atCrown Castle, a real estate investment trust engaged in the ownership, management, operation, and leasing of diverse real estate holdings. What sets Crown Castle apart is its unique approach within the REIT framework, centering its endeavors around communications infrastructure. More precisely, Crown Castle specializes in the acquisition of indispensable cellular network tower and transmitter sites.

Crown Castle has been in business for more than 25 years, and its network stretches across the lower 48 states with a particular focus on major urban areas. The company has over 40,000 cell towers in its portfolio, along with more than 85,000 route miles of fiber optic cables, and over 120,000 small cells on contract. Crown Castle builds its business, and its profits, on the continuing expansion of consumer demand for wireless connectivity.

The company reported its results for 2Q23 in mid-July and showed year-over-year gains. Crown Castle’s total revenue reached $1.87 billion, surpassing forecasts by $10 million and marking an 8.1% year-over-year increase. The revenue was driven by a 10% y/y rise in site rental revenue, totaling $1.73 billion. Additionally, the firm’s bottom line earnings figure, of $1.05 per diluted share, came in 1 cent better than the estimates – and was up 8% from the year-ago period.

Dividend investors should note that Crown Castle’s AFFO, adjusted funds from operations, a metric that supports the dividend, grew 14% y/y to reach $2.05 per share. This was more than enough to fully cover the company’s regular share dividend, which was declared on July 21 for $1.565 per share. This payment will go out on September 29; at its current rate, it annualizes to $6.26, and yields a solid 6%.

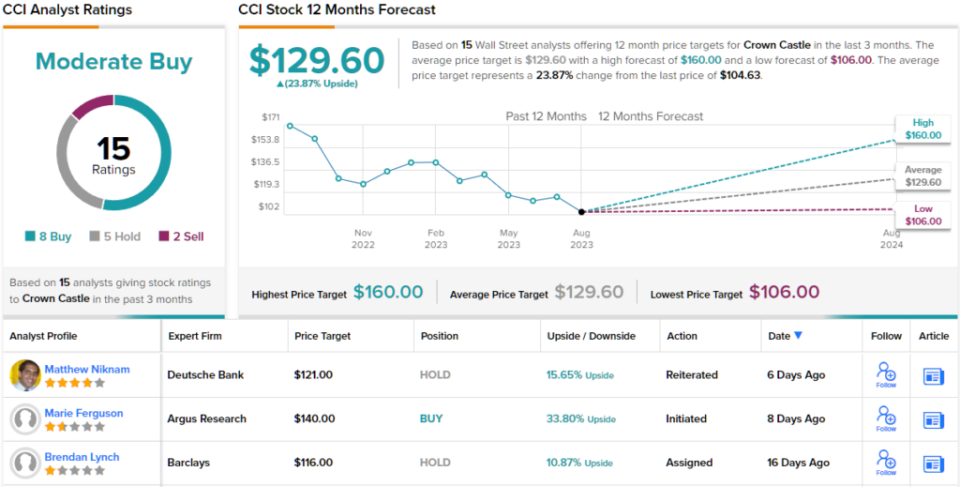

Analyst Marie Ferguson, from Argus, covers this stock, and is impressed by Crown Castle’s use of the REIT model to leverage cell networks for profits. She says of the company, “We expect CCI to benefit from the increased demand for 5G wireless communications, and have a positive view of its focus on small cells, which can be used to improve communications in congested urban areas and expand service to underserved rural communities. We note that CCI’s colocation tenants bear expenses under long-term leases, and that the current weighted average of its remaining contract terms is about six years… We expect carrier capital spending to increase in 2024, and believe that the current CCI share price offers investors a buying opportunity.”

Looking ahead, Ferguson rates CCI shares a Buy, and her $140 price target implies a one-year upside potential of ~34%. (Two watch Ferguson’s track record, click here)

Overall, Crown Castle gets a Moderate Buy consensus rating from the Street’s analysts, based on 15 reviews that include 8 Buys, 5 Holds, and 2 Sells. The company’s $129.60 average price target suggests a ~24% gain in store for the stock, from the $104.63 current trading price. (See CCI stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.