Get access to theSchedule 3 balance sheet formatand easily compare your business’s financial figures of assets, liabilities, and equities. Make informed decisions and improve your business’s operational efficiency by using thebest Billing Software for businesses.

Download formats

Download Vyapar

Download formats

Highlights of Schedule III Balance Sheet Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

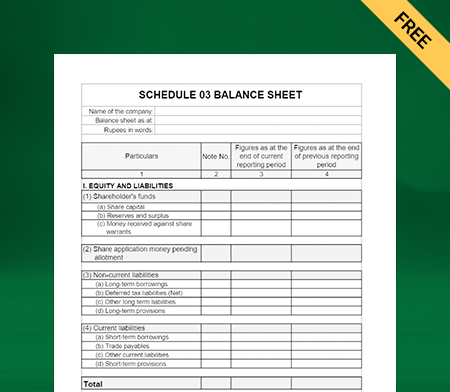

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

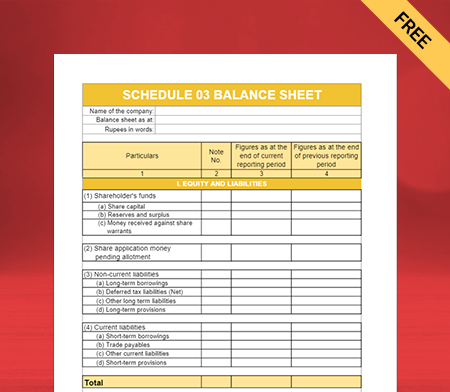

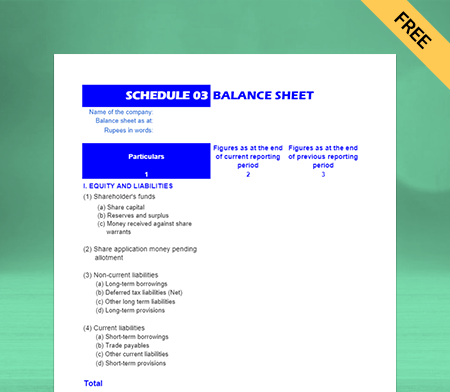

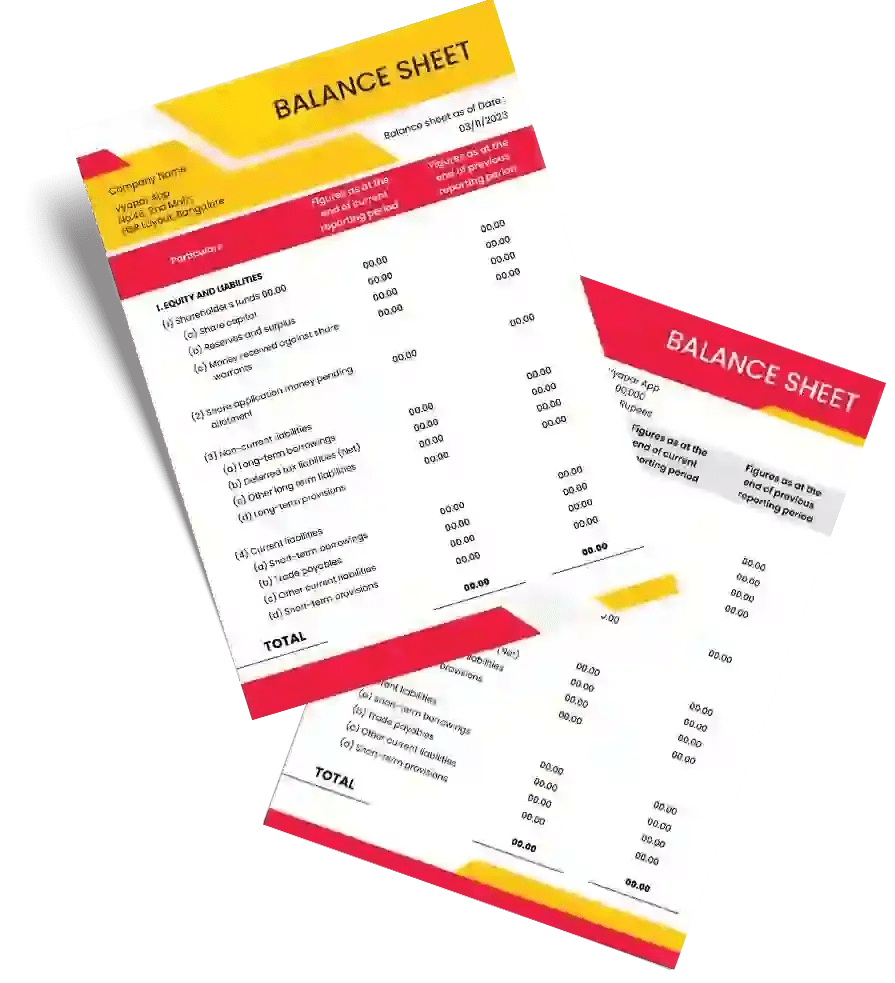

Download Free Schedule 3 Balance Sheet Format

Download free Schedule 3 Balance Sheet Formats, and make customization according to your requirements at zero cost.

Schedule 3 Balance Sheet Format Type I

What is Schedule 3 of the Balance Sheet?

On October 11, 2018, the Ministry of Corporate Affairs (MCA) amended Schedule III of the Companies Act 2013. Schedule III of the Companies Act 2013 provides the format of companies’ financial statements complying with Accounting Standards (AS) and Ind AS under its Division I and Division II, respectively. Now Schedule III applies to NBFC covered under Ind AS.

Download for Mobile

Benefits Of Using Schedule 3 Balance Sheet Format by Vyapar:

Access Data Any Time, Anywhere:

The most apparent advantage ofcloud accounting softwareis that it lets you access your data whenever and from whichever device you want. You can use it from your desktop or mobile phone, and all you need is an internet connection. It helps you create and send invoices directly from your mobile.

Save Time With Automation:

Manual and repetitive bookkeeping tasks such as creating invoices, tracking transactions, and logging journal entries take a lot of time daily. Using the Vyapar software, you can automate journal entries, invoice creation, and obtain financial statements by linking your accounts with the software. You can also set up automatic payment reminders and send them to your debtors.

Accounting Accuracy:

The Vyapar App ensures that your accounting records are accurate and adequate. The schedule 3 balance sheet format helps reduce human error during computation or data entry. The system will notify you if there is any mistake during entry or any error in the data. It ensures that all documents are readily available at tax filing and reminds you to collect debts and pay dues. The user can rely on the information as it is automated and accurate.

Reduce Paperwork And Improve Sustainability:

Using the user-friendly Schedule III balance sheet formats available in the Vyapar app, you can create a copy with a click, so you don’t have to make a photocopy manually. The invoices and records are stored with cloud encryption, and they are easily accessible if you have the correct permission. Also, you can create and send invoices directly from the software to your clients, reducing the time and money wasted on printing and posting the invoices.

General Instructions For Preparation of Schedule III Balance Sheet

Any change in treatment or disclosure required by compliance with the Act, consisting of any addition, modification, substitution, or deletion to the headings or subheads of the financial statements or statements forming part thereof, shall be made. The provisions of this Schedule shall stand modified accordingly.

The disclosure requirements specified in this Schedule III balance sheet are in addition to and not in substitution for the disclosure requirements outlined in the Accounting Standards prescribed under the Companies Act, 2013. The statements shall make additional disclosures specified in the Accounting Standards in the notes to accounts or supplementary statements. However, these disclosures are not required to be disclosed on the face of the Financial Statements.

In addition to that presented in the Financial Statements, Notes to accounts shall contain information, including narrative descriptions or disaggregations of items recognized in those statements; and information about things that are not qualified for recognition in those statements.

Each item on theBalance Sheetand Statement of Profit and Loss must cross-reference to any related information in the notes to accounts. In preparing the Financial Statements, including the notes to accounts, one shall balance providing excessive detail that may not assist financial statement users and not provide necessary information due to too much aggregation.

The figures appearing in the Financial Statements may be rounded off Depending on the Company’s turnover. If the turnover is less than 100 crore rupees, you can round it off to the nearest hundreds, thousands, lakhs, millions, or decimals. If the turnover is more than 100 crore rupees, then rounding off to the nearest lakhs, millions or crores, or decimals are allowed.

After incorporation, the first Financial Statements presented to the Company must also include corresponding amounts (comparatives) for all items, including notes shown in the Financial Statements, for the immediately preceding reporting period.

Create your first invoice with our free Invoice Generator

Download for Mobile

Difference Between Schedule III and Schedule VI Balance Sheet Format:

Schedule III of the Companies Act, 2013 contains a format for preparing and presenting financial statements. The revised Schedule VI notified under the Companies Act, 1956 is the same as the format of financial statements given in the Companies Act, 2013, except for the addition of general instructions for preparing Consolidated Financial Statements (CFS).

The revised schedule 3 of the companies act 2013 specifies compliance with accounting standards and the requirement of disclosures. The revised schedule 6 of the companies act 2013 introduces many new concepts and disclosure requirements in preparing profit and loss statements and balance sheets.

Download for Mobile

Features Of The Vyapar Schedule III Balance Sheet Maker App:

Accounting Security

The most significant advantage of the best cloud-based accounting features in the Vyapar schedule 3 balance sheet generator is that your records remain safely secure. Your data is synced at all times and covered with high-end encryption algorithms. The Vyapar App does not store users’ Google data, and whenever the app collects any data, it gets shown to the user. We recommend changing passwords at intervals and keeping the backups offline for safety.

Simplified Tax Compliance

The free schedule 3 balance sheet maker app helps with tax compliance. When you have accurate accounting records, up-to-date financial statements, and reports, gathering the documents and information required to file taxes is straightforward. Further, advancedonline accounting softwareby Vyapar has inbuilt tax rules, allowing you to focus on growing your business instead of worrying about dealing with the IRS.

Business Reports

After creating invoices, you can use the collected data to create a balance sheet and sales or purchase reports quickly to analyse different metrics of the growth of your business. You can create various reports like inventory reports to identify product demand and focus on keeping stock of them in-store. A tax statement can help you in filing taxes and GST seamlessly.

Manage all transactions

The free Balance Sheet Format maker lets you create and share invoices via multiple media like WhatsApp and email. It facilitates the user to enter a discount during the payments and provides them with a PIN for deleting any transaction. A seller can add extra charges like shipping, packaging, on tier invoices, and it allows you to check profit while making a new sale invoice.

Bank Accounts

Using the free accounting and billing software of Vyapar, companies can easily add, manage, and track payments more efficiently. Vyapar schedule III balance sheet formats support multiple modes of payments, so you can quickly enter the data whether your revenue is from banks or e-wallets. It is an efficient way to manage the accounts, but you must add your bank with the Vyapar software. Also, you can access the data from anywhere with internet connectivity.

Inventory Control

One of the most challenging operations for every business is to manage inventory. Using the Vyapar accounting balance sheet maker, you can keep track of the items, products, or equipment you need to sell your services. Doing this will avoid the threat of inventory shortages halting operations. Further, it will let you know about surplus inventory to avoid unnecessary purchases.

Frequently Asked Questions (FAQs’)

What is Schedule III of the Companies Act, 2013 balance sheet?

Schedule III of the Companies Act 2013 provides the format of companies’ financial statements complying with Accounting Standards (AS) and Ind AS under its Division I and Division II, respectively.

What is the benefit of using the Vyapar balance sheet maker?

It saves time and keeps all your accounting details in one place. The app facilitates online digital payments and ensures that all data is correct and calculations are made correctly.

What is the significance of the Vyapar balance sheet?

The balance sheet is a crucial document to know liquidity, leverage, efficiency, and rates of return.

Can I upload App data into the Tally software?

Yes. You can export data to Tally directly from the Vyapar app and seamlessly use it for your business requirements.

Does Vyapar work offline?

Vyapar is an Offline application, and you can use it anywhere, so you don’t have to worry about a lack of internet access or connectivity in any remote location you might plan.

Is there a template for invoices in Google Docs?

Yes, Google Docs does offer a valuable and user-friendly invoice template. Using invoicing software is a safer option if you need to keep track of multiple repeat customers and your invoices. You can download invoice templates for freelancers from the Vyapar website.

Please Provide a valid Phone Number Loading... Scan with your mobile camera Monitor yourbusiness activity from anywhere in the world, sync mobile app with desktop app. Success !! We have sent an install link to your WhatsApp. Please check and install the app.Enter Phone Number to Start Download for Free

How Useful Was This Post?

Click on a star to rate it!