Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

derivativescfa-level-2

19 Nov 2021

A coupon-paying bond’s pricing and valuation are the same as those of a dividend-paying stock. The difference is that the cash flows are coupons and not dividends. Fixed income forward and futures have several problems that are related to the carry arbitrage model.

- The bond price is usually quoted as a clean price in some countries. This means that the bonds’ prices are quoted without the interest accrued since the last coupon date. The quoted price is sometimes known as the clean price. When buying a bond, one must pay the full price, which includes the accrued interest. This is referred to as the dirty price. It is important to understand how the quoted bond price and accrued interest make up the true price and its effect on the pricing of derivatives. The quotation convention for futures contracts is based on the corresponding quotation convention in the bond market.

$$ \text{Accrued interest} = \text{Accrual period} × \text{Periodic coupon amount} $$

- Fixed-income futures contracts often consist of more than one bond that a seller can deliver. Since bonds are traded at different prices, a conversion factor (CF) is used to equalize all the deliverable bond prices.

- The cheapest-to-deliver bond arises when multiple bonds are delivered for a futures contract after conversion factor adjustment. Since the conversion factor is not precise, the cheapest bond in the open market will be availed for the seller to buy to settle the obligation.

The formula for a bond where the quoted price includes the accrued interest is:

$$ F_0=FV(S_0+CC_0-CB_0) $$

Where the quoted price of a bond does not include accrued interest, the spot bond price will be:

$$ S_0=\text{Quoted bond price}+\text{Accrued interest}= B_0+AI_0 $$

The future price is:

$$ F_0=FV(B_0+AI_0-PVCI) $$

Where:

- \(F_0\)= The future value of adjusted for carry cash flows.

- \(B_0\)= Quoted bond price at time 0.

- \(AI_0\) = Accrued interest.

- \(PVCI\) = The present value of all coupon interest paid over from time 0 to time \(T\).

The quoted futures price is:

$$ Q_0=[\frac{1}{CF}]{FV[B_0+AI_0 ]-AI_T-FVCI} $$

Where:

- \(CF\) = The conversion factor.

- \(B_0\)= Quoted bond price at time 0.

- \(AI_0\) = Accrued interest at time 0.

- \(AI_T\) = Accrued interest at time \(T\).

- \(FVCI\) = The future value of all coupon interest paid at time \(T\).

Example: Calculating Equilibrium Bond Futures Price

The following information relates to a six-month Euro bond futures contract with a value of €50,000. The underlying is a 5% bond quoted at €110 with an accrued interest of €1.00. Suppose there are no coupon payments due until after the futures contract expires.

$$ \begin{array}{lc|lc} \textbf{Futures Contract} & & \textbf{Underlying Bond} & \\ \hline \text{Euro Bond Contract Value} & €50,000 & \text{Quoted Bond price} & €110 \\ \hline \text{Conversion factor} & 0.65 & \text{Accrued interest since } & €1.00 \\ {} & & \text{last coupon payment} & \\ \hline \text{Time to contract expiration} & 0.5 & \text{Accrued interest at} & €3.00 \\ {} & & \text{futures contract} & \\ {} & & \text{expiration} & \\ \hline \text{Accrued interest over the} & 0 & & \\ \text{life of futures contract} & & & \\ \hline \text{Risk-free rate} & 4.00\% & & \\ \end{array} $$

The equilibrium bond futures price based on the carry arbitrage model is closest to:

$$ QF_0\left(T\right)= \left[\frac{1}{CF\left(T\right)}\right]\times FV_{0,T}\left[B_0(T + Y)+ AI_0\right]– AI_T – FVCI_{0,T} $$

Where:

- \(T = \frac {6}{12}\)

- \(CF(T) = 0.65\)

- \(B_0(T + Y) = € 110\)

- \(FVCI_{0,T} = 0\)

- \(AI_0 = €1.00,\)

- \(AI_T = €3.00\)

- \(r = 4\%\)

Therefore,

$$ QF_0\left(T\right)=\left[\frac{1}{0.65}\right]\times 110+1 \times 1.040.5– 3 – 0= €169.54 $$

The value of a bond future is the change in price since the previous day’s settlement. This is because bond futures are marked to market. The futures value is captured at the end of the day during the bond settlement, at which time the contract value is zero. The value of a bond is the present value of the difference in forward prices. Carry benefits reduce forward prices and carry costs increase forward prices.

Question

Consider a $100 par, 4% semiannual coupon bond with a spot price of $100 that matures in 200 days. The bond has just made a coupon payment and the next coupon payment will be made after 60 days. What will be the value of the bond after 120 days?

Given that the risk-free rate of interest is 8%, the value of the forward contract on the bond to the long position is closest to:

- $112.72.

- $14.18.

- $127.

Solution

The correct answer is B.

$$ \text{Coupon payment} = 4\%\times 0.5\times 100 = $2 $$

Present value of coupon payment \(= \frac{2}{\left(1.08\right)^\frac{160}{365}}=$1.93\)

$$ \begin{align*} F_0(T) & =\left(110-1.93\right)\times\left(1.08\right)^\frac{200}{365}=$112.72 \\ V_t\left(\text{Long} \right)&=\left(S_t-PVC_t\right)-\frac{F_0\left(T\right)}{\left(1+r_f\right)^{T-t}} \end{align*} $$

After 120 days, only one coupon payment is due in 40 days (160-120) before the contract maturity in 80 days (200-120).

$$ \begin{align*} PVC_t & =\frac{2}{\left(1.08\right)^\frac{40}{365}} =$1.9832 \\ V_{120} \left(\text{Long} \right) &=$127-1.9832-\frac{$112.72}{\left(1.08\right)^\frac{80}{365}}=$14.18 \end{align*} $$

Reading 33: Pricing and Valuation of Contingent Claims

LOS 33 (d) Describe how fixed-income forwards and futures are priced, and calculate and interpret their no-arbitrage value.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

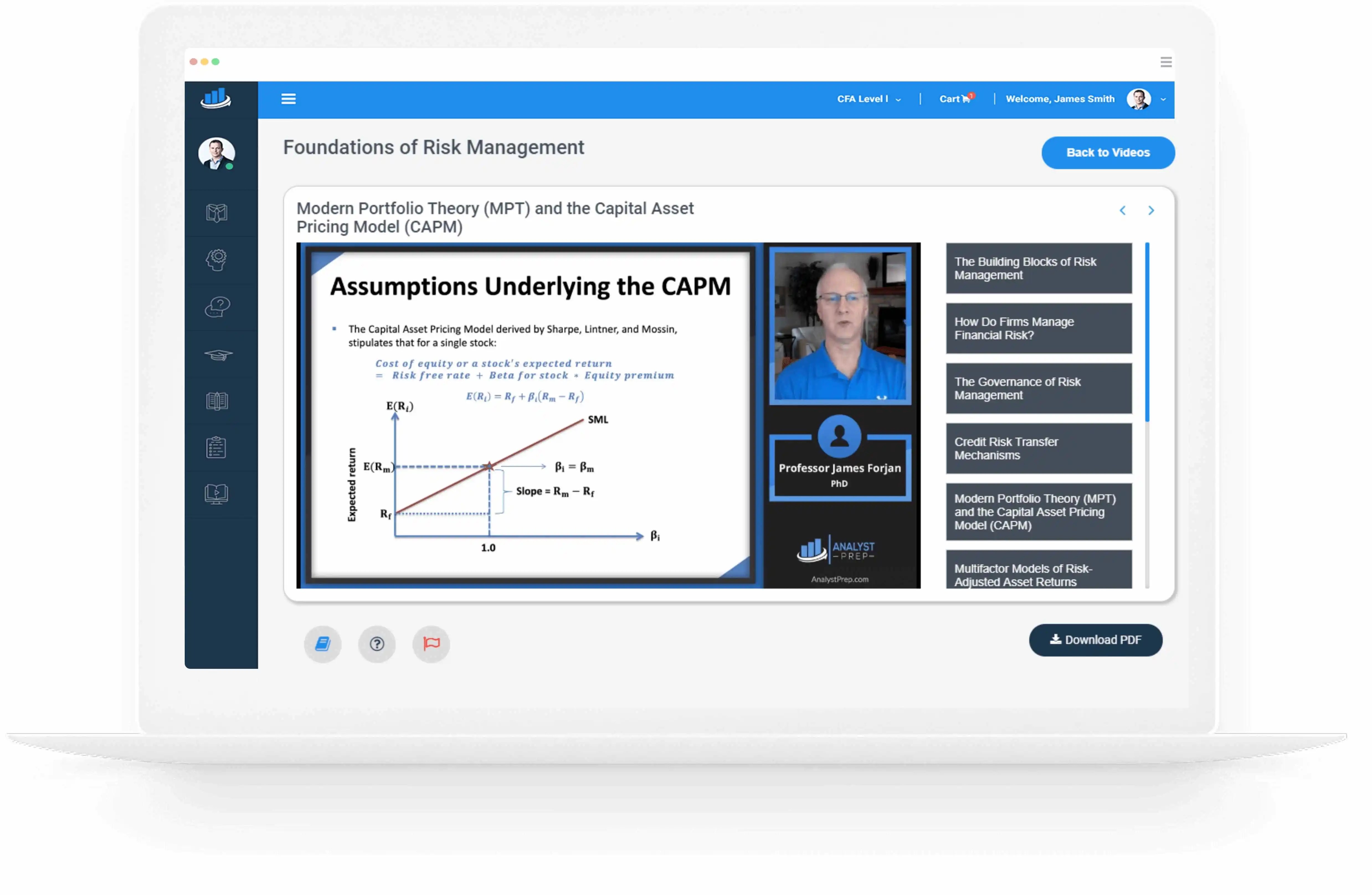

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts