What is Operating Profit Margin?

Operating Profit Margin is one of the measures to calculate the profitability of a company. Like other profitability ratios, Gross Profit Margin, Pre-tax Profit Margin, and Net Profit Margin, Operating Margin throws more light on how profitable a company is. Let us take a deep dive into what this measure of profitability is and how it impacts the overall performance of a business.

| 💸 Reduce costs and put more money back into your business with Wise. Find out how! |

|---|

What does Operating Profit Margin tell you?

To be more specific, Operating Profit Marin tells us how much the operating costs (i.e. running expenses) are in comparison to the revenue generated. A positive operating margin indicates that your business can make enough money to cover the operating costs. On the other hand, a negative Operating Profit Margin would be a cause for concern since the revenue is not enough to cover the operating costs.

Where the gross profit margin only considers the direct costs associated with producing a product or service (like material, shipping - also known as the Costs of Goods Sold or COGS), the operating margin includes the additional costs involved in running the overall business. These include salaries, rent, depreciation, selling, and marketing costs.

The Operating Profit Margin is a better indicator of the overall performance of a business because it gives a more clear view for where and how costs that are within control, can be managed. .

Operating Profit Margin formula

🔢 What is Operating Profit and how to calculate it?

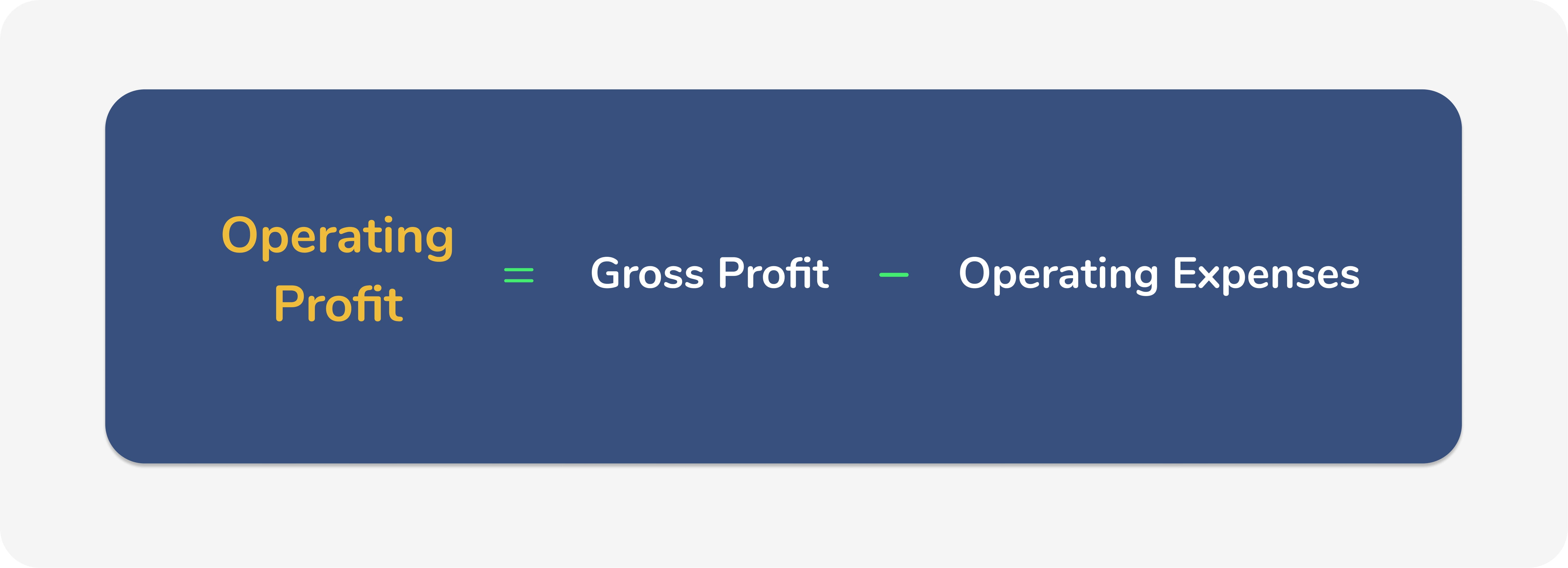

Understanding how Operating Profit is calculated is important in calculating the margin. Operating Profit is the net amount after operating expenses has been deducted from Gross Profit (Revenue - Cost of Goods Sold)

Here's the formula:

Remember, the operating expenses contain costs which the business has more control over. These include salaries, rent, depreciation, selling and marketing expenses.

Example of an Operating Profit Margin calculation

Consider the following components of an Income Statement:

Now let’s apply the formulas we’ve shown above:

Operating Expenses = 25,000 + 35,000 + 5,000 + 17,000 + 3,000 = 85,000

Operating profit = 125,000 – 85,000 = 40,000

Operating profit margin = 40,000/300,000 x 100 = 13.33%

Why is it important to know your Operating Profit Margin?

The operating profit margin can reveal a lot of insights about the company. It indicates how much operating cost goes into per unit of revenue earned. The management can look into this figure and decide whether or not some of these costs can be controlled to improve profitability.

The operating profit margin also determines the ability of the a company to address its interest payments. It can also help the management decide whether to deploy more leverage to enhance the return to its shareholders. Operating profit is also compared to the interest payments to understand the creditworthiness of a company.

What is a good Operating profit margin?

What constitutes a good profit margin depends on the industry in which a company operates.

As a general rule, a 10% operating profit margin is considered an average performance, and a 20% margin is excellent. It's also important to pay attention to the level of interest payments from a company's debt. Two companies with the same Operating profit and margin may exhibit differences in their profitability performance if the level of debt is different.

It's also important to keep in mind that the tax component is not considered while making this assumption especially for companies that are operating in different jurisdictions where tax laws might be different. The tax rate may also vary depending on the industry, and the margin would have to be tweaked based on the company’s industry.

🌎 Manage different currencies easily and cheaply - choose Wise for Business

If your business deals with contractors from overseas or selling at different locations, you might want to find a way to reduce the overall international payment costs as these transactions are usually expensive using traditional methods like banks or PayPal.

Online platforms like Wise for Business can help you manage foreign exchange better and reduce costs while making or receiving payments in multiple foreign currencies.

Wise has features like batch payments to multiple contractors/suppliers, automated recurring payments, secure money management and easily trackable transactions all in one account. This removes the hassle of having multiple accounts for each currency with banks.

Start saving today with Wise

Final Thoughts

Better cost management ensures the Operating Profit Margin remains healthy, and this can be challenging, especially for an international business. Selling to international clients requires expertise in foreign markets, translating to higher costs like marketing and selling.

Managing payments for goods received and sold can also add another dimension since it would require forecasting the amount in foreign currencies.

Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information. This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.