- HubPages»

- Personal Finance

Updated on February 5, 2013

Saving Money Takes Effort

It seems second nature to buy, charge on the credit card and then face the reality later. Is this such a good idea? Not usually. Like sleepwalking, accidents can happen. Alert spending habits throughout the month can avoid a disaster. Most of the time, this means sticking to a plan, a budget, or even a routine.

New habits can be easily learned, and here are some fairly easy ways to get started:

- Meals - by limiting meals to three times a day, you save money.

- Instead of going to the malls - take a walk in nature.

- Instead of going to the supermarket out of force of habit, write a large list and minimize shopping "visits". They can be very expensive.

- What is spent should - and can, easily be recorded in a spreadsheet on ongoing basis. The truth is usually not so bad - and now you have orientation as to where the money is actually going. (This type of activity is self-respect generating, too :))

Your Money or Your Life?

Comfort Zone / Reality check

Pavlov's Dog. When the bell rings, he salivates, because he's been trained to know that a bell precedes his nice, juicy steak dinner. Bell - saliva.

We humans have similar reactions to certain words.

Negatives:

The words Budget, just like Exercise, Insurance, Dental Appointment may invoke a negative connotation. Ugh! Sigh!

Positives:

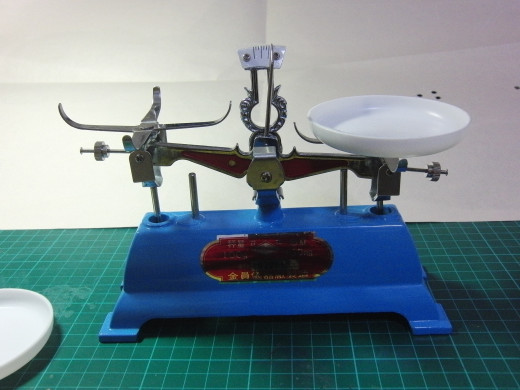

Money - on the other hand - invokes an impression of freedom, possibilities, flexibility and so on. Like a see-saw or an old fashioned scale, unless you have access to an unlimited supply of money, it's hard to be so flexible or free.

Past - Present - Future

A wise person once said: If you want to see where you are now it's based on what you did in the past. Where you want to be in 5 years' time is based on what you are doing right now, this very minute! Think about that!

My son's 5th grade teacher also explained that 5th grade corresponds to 8th grade. If students are weak in the 5th grade, they will suffer for it in the 8th grade, 6th / 9th and so on. Like planting a seed, the result is all that much sooner to sprout.

Weigh in your expenses: Cost vs. Benefit

Start now!

Congratulations for being willing to get out of your comfort zone. The fact that you're willing to take a peek at your current financial situation is awesome. You may feel more comfortable recording your information when you are all alone so you can concentrate and look at the situation squarely.

Tracking expenses

Most people go on automatic when it comes to spending money. Impulse buying - or in a trance - needs to be avoided at all cost. FOCUS, waking up and tracking expenses are part of a new mind set that will bring you to the place you want to be!!

Finances are a personal matter. Whether you include another person in on the process or not, without knowing where you are at this moment, it will be difficult to chart a course to where you want to be.

Staying engaged

Try to remember where you are and what you're doing. Whenever I get near a trendy clothing store I hear the party music start. They are trying to hypnotize me! Another store I know pumps the smell of bubble gum. They are just jeans and tennis shoes, not a party in a box.

Pre-planning with an estimated spending plan can help make a big difference in the monthly bottom line.

A budget, may quite possibly give you:

- Self respect (sticking to your budget - it can always be adjusted if it doesn't make sense)

- High self esteem (I'm not rich, but I have some money saved for a rainy day and for my retirement)

- Money to fall back on in a pinch (at least a month or two's income in case the paycheck stops coming)

- A basis for knowing what your boundaries are in spending habits ...AND, perhaps most importantly:

- Perspective as to where the money actually went. If it's not a satisfactory result, you will be able to change it next time. Kind of nice to be in control of it and not you, right?

Scenario #1 - 3500 / month

Category | Percentage | Amount |

|---|---|---|

Housing | 38% | 1330 |

Insurance | 5% | 175 |

Transportation | 14% | 490 |

Debts | 5% | 175 |

Food | 14% | 490 |

Medical | 5% | 175 |

Recreation | 2% | 70 |

Education / Child Care | 5% | 105 |

Hygiene | 2% | 70 |

Miscellaneous | 2% | 70 |

Savings | 5% | 105 |

Investments | 0% | |

100% | 3500 |

Play around with the numbers to have them make sense for your personal situation. A student would have higher educational expenses, and a professional might have a clothing category. A good rule of thumb is to save at least 10% of the take home inc

Got to Start Somewhere

Budget Guidelines

Just an idea to help get started......

Housing: 38%

Insurance: 5%

Transportation: 14%

Debts: 5%

Food: 14%

Medical: 5%

Recreation: 2%

School/Child Care: 5%

Hygiene: 2%

Personal: 3%

Miscellaneous: 2%

Savings: 5%

Investments: 0%

Total: 100%

Tracking Expenses

Keeping a Budget

Importance of Savings

How much of your income can you put on the side? I know someone who saves 70% of their income!

PAY YOURSELF FIRST

5-10% is the absolute minimum. 20% is better. Wants and needs are completely different. That daily coffee can be modified to a Friday coffee splurge. If you feel up to a part time job, at least until you have three to six months' worth of expenses put away, that would be even better. Moving in with mom and dad until you save up a chunk is another option. How to lower expenses in a meaningful way? Think - and don't be afraid to get creative!

Super high interest payments

If you got suckered into paying a high interest loan, at least half of your savings could be dedicated to paying off that debt ASAP. Leave a little on the side for emergencies, though. You will need it! ! !

Making it Personal

Use your credit card statement or receipts to get a basic idea of what your spending footprint looks like. Ideally, data from the past three months would give a more accurate picture, adding up the totals and dividing them up by three to get an average:

Income

- the J-o-b

- the side job (carpentry work, selling cosmetics... you name it)

- Passive income, i.e. rent out the garage

- Babysitting / HubPages earnings...

- Birthday money received

Fixed Expenses - Mortgage and Rent, in most cases, and any car payments or loans. These are the expenses that aren't negotiable, at least not right now!

Non-fixed Expenses - Groceries, Credit Card Expenses, Gasoline, and most likely utility bills like electricity, telephone, and so on. Using coupons, changing shopping and other habits can lower your bill here from 10-15% or more.

Now it's time to evaluate. Say the income is 3500 (again) and fixed expenses (like Rent, Mortgage, or a Loan payment) add up to 2000. Most of your concentration is going to be "Fixed" on the Non-Fixed categories to see what areas could be adjusted.

Excel (or any other) Spreadsheet to identify spending

One of the best ways of doing this is by using an Excel spreadsheet. Using rows 1 to 31, each row is the day of the month and each column is for a spending category. On a day by day basis, track everything you spend to see where the leaks are. This is just for your information, the IRS won't be calling, so, just write it down. By month's end, the picture will be clearer. The truth can only set you free, so try enjoy the process because after all, knowledge is power. Use the receipts to keep the amounts honest and put them in an envelope for monthly, then annual receipts. It is almost a game!

For example, my friend tracks her expenses, then downloads her photos every night, just like brushing teeth before going to bed. Make it a part of your life. In a month or so you will see the picture emerge and be able to identify the problem areas.

For example, is Starbucks taking in 30% of your mad money? "That's cool" if you love their coffee so much. If you would rather spend half of that on going to the movies or a club, time to make an adjustment.

Where there is a will, there is always a way.

Passive Income $$

Financial Independence - the Possible Dream

True Life Stories

- In 1990, my friend and her husband bought their first home. For years, she had been paying herself first - before anyone else. They bought a home,complete with rental units below, and since the city of San Francisco doesn't have enough apartments to rent, they made nearly enough from rents to pay their mortgage. Long story short, they are doing very well by now!

- Another friend bought a four-plex in a great LA residential area. The worst looking (Gothic looking) house on the block, it was being repossessed by the bank. She had just enough for the down payment! Choosing the least desirable unit for herself, she rented out the other three other units. Her tenants effectively pay her mortgage, upkeep and utilities every month.

Making a little or a lot is not important. It's what you do with it. Decide right now that you won't live with financial regrets. That means - spend less than you make (even if it is a dollar less!), and pay yourself first.

Others have done it before. You can too!

Good luck!

Keeping track

Shopping for Young Children - and SAVE

- Cut Expenses and Live More Frugally

How to save money? Making more money helps, but most importantly, try to spend less wastefully by living frugal. Hot tips and suggestions to help get you started. It's not what you make, but what you keep in the end that matters! - How to Shop Frugally for Babies and Young Children

Frugal living with children can be a challenge. They outgrow clothes and toys in a matter of months - what to do? This Hub answers all those questions and more. Addressed to parents who want to save money instead of squandering on very short time usa