“That’s good.

My hips aren’t

what they were.”

– Addie

Fetch is the most comprehensive dog insurance plan in the U.S. & Canada. It gets tails wagging.

Use any veterinarian in the U.S. or Canada

Rated ‘Excellent’ on Trustpilot

Covers up to 90% of unexpected vet bills

Trusted by lifesaving shelters in the U.S. and Canada

How does Fetch dog insurance compare?

Fetch covers what other providers charge extra for or don’t cover at all. See how different dog insurance companies stack up.

See the Fetch difference:

Click through the list to learn more.

Sick-visit exam fees

$1,000 in online vet visits

Behavioral therapy

Every tooth, plus gums

Alternative & holistic care

$1,000 in boarding fees

Sick-visit exam fees

Every sick visit comes with an exam fee, which can be around $50 - $250. We cover those exam fees for you. Not all providers do.

Trupanion & Healthy Paws don’t cover this. Lemonade, Nationwide, Pets Best & Figo charge extra for it.

$1,000 in online vet visits

Remote treatment by a vet via phone, email, text or video chat is covered up to $1,000 per year — no copay required.

Trupanion & Healthy Paws don’t cover this.

Behavioral therapy

Consultations with a vet to diagnose and treat behavioral disorders are covered by Fetch — up to $1,000 per year.

Healthy Paws doesn’t cover this. Lemonade, Trupanion, Nationwide & Figo charge extra for it.

Every tooth, plus gums

Every adult tooth and your pet’s gums are covered against injury and disease. Not all providers offer complete coverage. We do.

Lemonade, Nationwide, Pets Best, Healthy Paws & Trupanion don’t cover this. Figo charges extra for it.

Alternative & holistic care

We cover treatments like acupuncture, aromatherapy, chiropractic and homeopathic therapy administered by a vet to treat an injury or illness. Not all providers do.

Lemonade doesn’t cover this. Trupanion, Nationwide & Pets Best charge extra for it.

$1,000 in boarding fees

Fetch cares about pet parents, too. We cover the cost to board your pet at a licensed facility when you’re hospitalized for 4 days or more. You’re covered up to $1,000 per year.

Lemonade, Embrace, Nationwide, Healthy Paws, Pumpkin, Pets Best & ASPCA don’t cover this. Trupanion & Figo charge extra for it.

And so much more!

Fetch covers (and loves) dogs of all ages

We cover dogs of all ages — from the time they’re 6 weeks old all the way through their golden years. Not all providers do. Your best friend is your best friend, no matter how many birthdays they’ve had.

COVERED

COVERED

Puppies

6 weeks - 1 year old

COVERED

COVERED

Adult dogs

2 - 7 years old

COVERED

COVERED

Senior dogs

8 years old & beyond

Rated 4.7 in the App Store & Google Play. *Updated July 2023.

How does Fetch dog insurance work?

Use any veterinarian in the U.S. or Canada

With Fetch, you have the flexibility to keep your current vet or use a new vet if you’d like. We even cover specialists and emergency clinics.

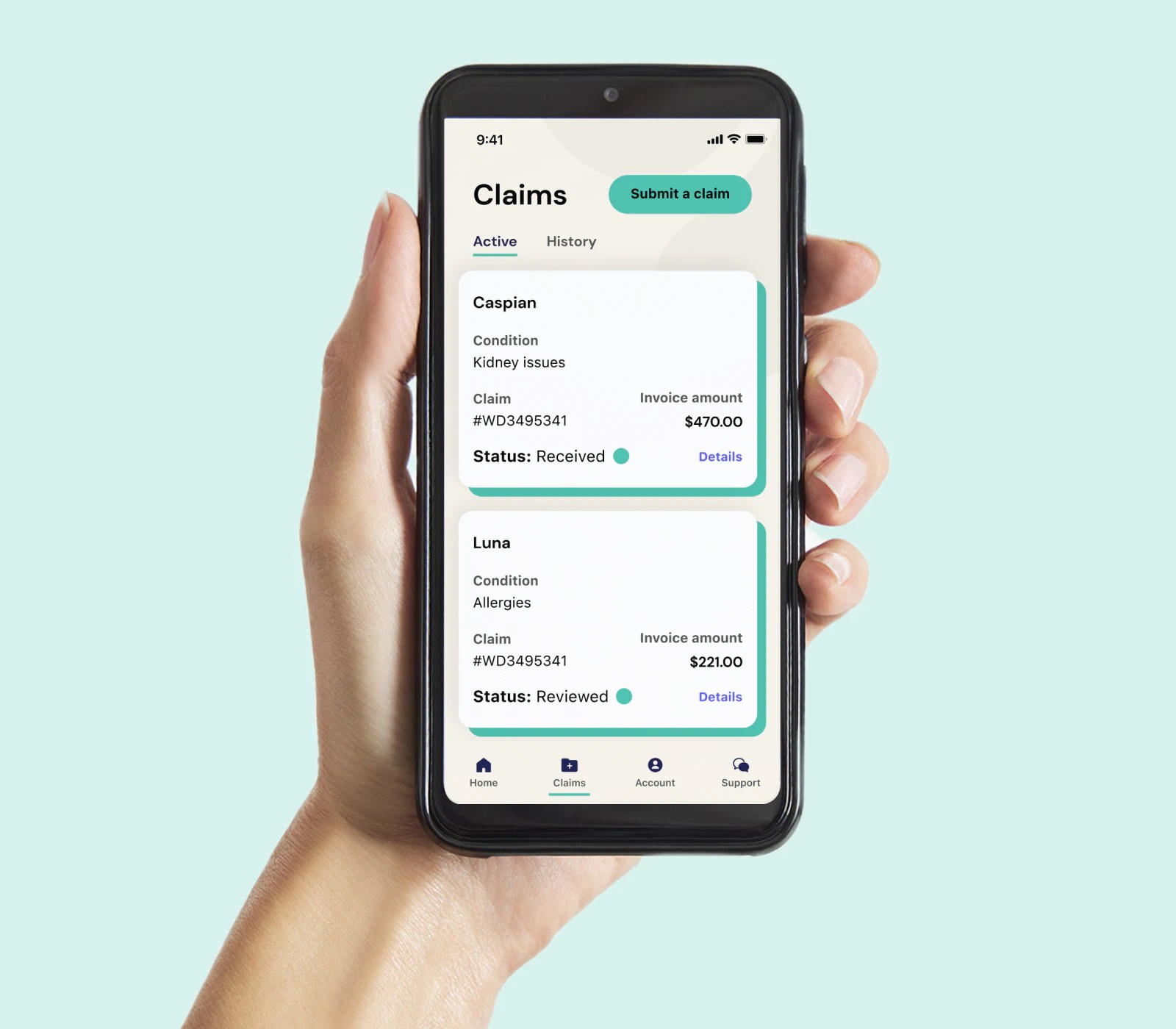

Submit a claim in minutes

Just take a picture of your vet documents, answer a few questions about your pet’s treatment and we’ll handle it from there.

Get paid back fast

Once your claim is approved, you’ll be paid back up to 90% of your unexpected vet bill in as little as 2 days via direct deposit.

Explore dog insurance by breed

Fetch offers dog insurance plans to cover every breed, from large breed dogs to small. Check out the average insurance price for your dog’s breed here and get a free quote for your best friend today.

Get a breed-specific price

Golden Retriever

Goldendoodle

Shih Tzu

German Shepherd

Yorkie

Why veterinarians choose Fetch dog insurance

Don’t just take our word for it – here’s what a top veterinarian has to say.

“No one wants to think about accidents or illnesses when it comes to their dog, but even the most loved pets aren't immune. Data shows that being proactive about your pet's health is key to giving your dog a longer, healthier life — and Fetch Pet Insurance is the best way to do just that.”

Dr. Audrey Ruple, DVM, MS, PhD, DipACVPM, MRCVS

Veterinarian, Dorothy A. & Richard G. Metcalf Professor of Veterinary Medical Informatics & Chair of the Fetch Veterinary Advisory Board

See what pet parents say about Fetch dog insurance

We’re proud of our 'Excellent' Trustpilot rating and love hearing about how Fetch has positively impacted our community.

If your vet recommends it, Fetch probably covers it

With Fetch, your pup can see any vet in the U.S. or Canada. Like most other dog insurance plans, Fetch does not cover pre-existing conditions. That's why it's helpful to get coverage as soon as you can. Getting Fetch means peace of mind, all in one simple dog insurance plan.

Vet bill costs are based on U.S. dogs' annual policy terms between 1.1.2021 - 12.31.2022, where the dogs are 2+ years of age. Fetch pays back is based on a policy configuration of an unlimited max annual payout, an annual deductible of $500 where the deductible has been met and a reimbursem*nt rate of 90%.

Sick-visit exam fees

Every sick visit comes with an exam fee, which can be around $50 – $250. We cover those exam fees for you. Not all providers do.

Breed-specific issues

Not all providers cover medical conditions linked to breed, like breathing problems in French Bulldogs or kidney stones in Burmese.

We do.

Boarding fees

We care about pet parents, too. Fetch covers the cost to board your pet at a licensed facility when you’re hospitalized for 4 days or more. You’re covered up to $1,000 per year.

Advertising & reward

If your pet goes missing, we want to help. Fetch covers the cost of advertising that your pet is lost and paying a reasonable reward for finding them. Your plan includes coverage up to $1,000 per year.

Name-brand prescription medications & supplements

We cover medicines like antibiotics and insulin, as well as natural supplements like vitamins and herbal therapies, when they’re recommended by a vet to treat a new injury or illness.

1 in 3 pets need unexpected veterinary care each year

Here’s a look at how much English Bulldogs, like Petey, rack up in vet bills in a year, on average.

English Bulldog's vet bills:

$2,404

Fetch pays back:

$1,913

Vet bill cost is based on the average vet bills for U.S. English Bulldogs' annual policy terms with effective date between 1.1.2021 - 12.31.2022 where the dogs are 8 years old. Fetch pays back is based on a policy configuration of a max annual payout of $5,000, an annual deductible of $250 and a reimbursem*nt rate of 90%.

Your dog insurance questions – answered!

What is dog insurance coverage?

If your pet gets sick or hurt, dog insurance coverage reimburses you. Fetch dog insurance offers the most comprehensive coverage in the U.S. and Canada and pays you back up to 90%, making your vet bills more affordable. With Fetch, you won’t have to choose between your wallet and your best friend, and it’s easy to give your dog the care they need to live their longest, healthiest, happiest life.

Why do I need a dog insurance plan?

Every 6 seconds, a pet parent is faced with a vet bill of more than $1,000. That doesn’t even take into account the rising cost of inflation, or the fact that veterinary medicine is getting better – and more expensive. Fetch dog insurance plans give you protection from these increasing costs and peace of mind that’s priceless. From allergies to name-brand prescriptions to a cracked tooth, Fetch can offer coverage for a wide range of injuries and illnesses. As a pet parent with Fetch, you’ll be able to give your dog the care they need – without worrying about the full cost of vet bills.

When should I get dog insurance coverage?

The sooner you enroll, the sooner your dog’s covered. Fetch covers dogs and cats 6 months and older, but to make sure your pup gets as much dog insurance coverage as possible, it's best to sign up before they need it. Like most other dog insurance providers, Fetch doesn’t cover pre-existing conditions – which is why we recommend signing up as early as possible. Insuring your dog before health issues develop is recommended, so you and your best friend can live your best lives together.

What’s not covered?

Like most other dog insurance providers, we don’t cover pre-existing conditions. These are medical conditions that first occurred, or your dog showed clinical signs of, either before the effective date of your Fetch policy or during the waiting period of up to 15 days. The good news: If your dog has a medical condition or injury that can be completely resolved without recurrence, or showing any clinical signs – then goes one year from the original incident without any symptoms or treatment, this could be considered a curable medical condition and covered later.

How much does dog insurance cost and how is it determined?

At Fetch, your dog insurance plan’s cost will never be affected by sex, medical and behavioral history, spay or neuter status and indoor or outdoor status. So what do we factor in when we’re determining your plan’s cost? It’s simple: your dog’s age, breed and location. From there, you’ve got options. Here are the different factors you can customize to make sure your price fits your budget.

Dog insurance terms — decoded:

Maximum annual payout

The maximum dollar amount you can be paid back each year. Choosing a lower max annual payout will make your price lower.

Annual deductible

The amount of vet care you need to pay for yourself before we can reimburse you for claims. Choosing a higher deductible will make your price lower.

Reimbursem*nt

The percentage of an approved claim total that we can cover. You can choose 70%, 80% or 90%. Choosing a lower reimbursem*nt rate will make your price lower.

How much does a vet visit cost without dog insurance?

The cost of vet visits without dog insurance varies widely and depends on factors like your dog’s breed, age, location and, of course, what brings you and your pup to the vet in the first place.

Let’s say your Australian Shepherd has a bout of vomiting and diarrhea (dogs, they’re just like us!). Your vet bill would cost, on average, $905 without dog insurance coverage. Fetch covers up to 90% of your unexpected vet bills after you’ve met your deductible – in this case, $814 would be covered. Getting Fetch means getting a significant reduction in your vet bill costs, so that your pup gets the medical attention they may need, and you’ll be protected from the full cost of vet expenses if they do.

Why is Fetch dog insurance worth it?

In addition to offering the most comprehensive dog insurance in the U.S. and Canada, we offer expert-backed health advice and data-driven insights to help you care for your dog from adorable puppyhood through their golden years.

Fetch Health Forecast >

The Fetch Health Forecast is the world’s first predictive AI health tool personalized for your dog. This groundbreaking technology uses 17 years of clinical health findings and 180 million data points from over 800,000 dogs to identify common health conditions. Peek into your dog’s future health so you can take preventive action today and help your pup live their healthiest, longest life.

The Dig >

Read up on the latest pet-parenting tips and health advice when you visit The Dig — your one-stop resource for all things dogs and cats. Want to learn more about pet insurance for dogs? Check out what the experts have to say:

The comparison is accurate as of July 2023 and is subject to change.

1 out of 3 pets needs unexpected veterinary care each year according to Carroll Hospital Center. February 2022.

Every 6 seconds a pet owner is faced with a vet bill of more than $1,000 according to NBC News. September 2018.

This is a summary of the coverages in your pet health insurance policy from Fetch. No coverage is provided by this summary nor can it be construed to replace any provision of your policy. You should read your policy and review your Declarations page for complete information on the coverages you are provided. If there is any conflict between the policy and this summary, the provisions of the policy shall prevail.

For residents of DE, LA, ME, MS, NE, NH, WA, click to review an Insurer Disclosure of Important Policyholder Provisions.

Program not available in New Brunswick and Quebec.

This information is descriptive only. Policy activation periods, risk free cancellation terms, waiting periods and other terms vary by state. Exclusions apply, such as pre-existing conditions. Please see your policy for full terms and conditions of coverage.

This product information is for descriptive purposes only and does not provide a complete summary of coverage. Consult the applicable insurance policy for specific terms, conditions, limits, deductible, copay, limitations, and exclusions to coverage; these may vary by state and are subject to change without notice. The coverage for each policyholder will be governed by the terms and conditions of the applicable policy. All coverage and limit options may not be available to all customers and are subject to underwriting approval. If there is any conflict between the policy and this product information, the provisions of the policy shall prevail.

Discounts and offers are subject to approval and may change at any time. Maximum available discount is 10% and may not be available in all states and is not valid with any other offer. Charitable donations offer not available in AK, HI, ID, IN, KS, ND, NY, RI, SC, or TX, limited to $15 in AL and $10 in MI and UT.

Fetch insurance policies are administered by Fetch Insurance Services, LLC (d/b/a Fetch Pet Insurance, Fetch Pet Insurance Services, LLC in Michigan, North Dakota, New Mexico and California) CA license # 0F60627 and underwritten by XL Specialty Insurance Company, a Delaware Corporation, or AXIS Insurance Company, an Illinois Corporation, in the U.S. and AXIS Reinsurance Company (Canadian Branch) in Canada. For more information, visit fetchpet.com. ©2024 Fetch, Inc. Information accurate as of January 2024.

Fetch Forward and The Dig are not insurance and are not provided by XL Specialty Insurance Company or AXIS Insurance Company.

Fetch is a registered trademark owned by Fetch, Inc. Long Live Love, Because Pets are family, and The Pet Gala are service marks of Fetch, Inc.

Unmatched according to The Dodo, May 2022. The Dodo is the #1 animal brand globally on social media according to Tubular as of January 2021. Most comprehensive and most extensive coverage according to Consumers Advocate, January 2023. Based on a comparison of injury and illness coverage between Fetch and North American pet insurance providers on consumersadvocate.org. Consumers Advocate is a Fetch partner. Best pet insurance according to Consumer Rating, August 2023. Based on a comparison of top pet insurance companies on consumerrating.org. Consumer Rating is a Fetch partner.

Average monthly premiums are based on U.S. annual premiums, using a 12-month average, for the period of 01.01.2022 through 12.31.2022 and all available limit combinations.

Exam fees based on average costs. Policies in force and number of pets helped based on Fetch data as of 10.12.2023.

Fetch Wellness is insurance coverage added by endorsem*nt to the core injury and illness policy, if purchased. It is not a “Wellness Program” meaning a subscription or reimbursem*nt-based program that is separate from an insurance policy.

1 out of 3 pets need emergency veterinary treatment each year according to MetLife Pet Insurance. 6 Shocking Pet Health Statistics. Published February 2022.