The Budegting Routine That Will Change Your Life

It may sound like a bit much to say a budget completely changed my life, but it’s 100% true. I know most people aren’t like me—and they don’t get all excited and giddy at the thought of doing a budget. In fact, just the word budget probably strikes terror in the hearts of so many of you.

Part of the problem is the bad reputation budgets get: “If I have a budget, I won’t be able to spend any money” or “It’s not possible to have fun on a budget.” But, nothing could be further from the truth.

The truth is, having a budget gives you freedom to spend.

With a budget, you’ll know exactly how much money you have to spend in any given category. You’ll never worry or wonder “Can I afford that?” Or, if I buy [insert item here], will I still be able to afford the electric bill?

Budgeting takes away the stress of managing money and gives you a clear cut spending plan.

And, a zero-based budget is the #1 tool that enabled me and my husband to pay off $105K of debt in three years! I’ve created a FREE guide that talks about the 9 proven steps we took to pay off debt faster than I ever thought possible. You can get your free copy by signing up below!

This blog post will talk about what a zero-based budget is, when and how to make one, with a real life (ok, totally made up, but you get the idea) example of exactly how to make one. I’ll also talk about common budget categories to include in your zero-based budget as well as FAQs I get about using a zero-based budget. Ready to roll? Let’s dive in!

A zero-based budget is a method of budgeting, where your income minus your budgeted expenses = 0. It means you allocate every single penny of your income to a certain budget category.

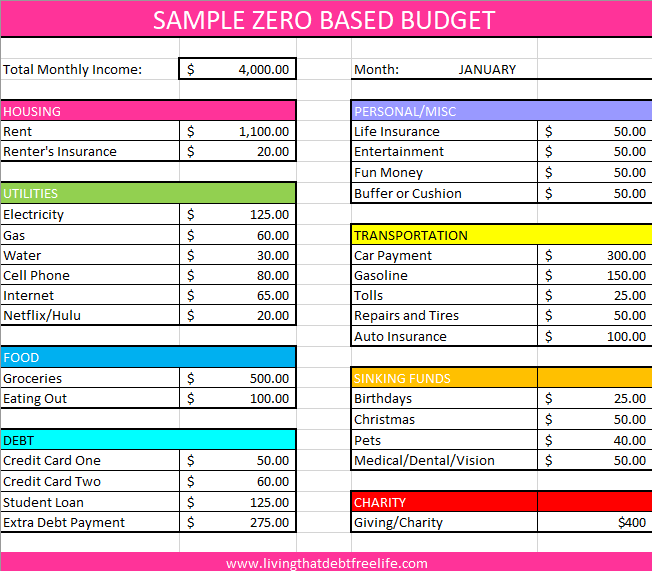

So, for example, if you earn $4,000/month, your zero-based budget will allocate $4,000 to your monthly budget categories. Your income ($4,000) minus your expenses (4,000) = zero.

A zero-based budget is a plan for every single penny of your income. Once your zero-based budget is in place, you won’t wonder where your money went. You’ll know exactly where it went, because you planned it—down to the last dime.

The time to make your zero-based budget is before you get paid. If you get paid, and start spending money without a plan in place, that money will be gone before you know it, and you’ll be left wondering “Where did all my money go?”

With a zero-based budget, you’ll never wonder where your money went, again.

I use a paycheck method of budgeting, where I plan what bills and expenses will be paid from each check I get. If you’d rather budget on a monthly basis, that’s fine too. The important thing to remember, is that you need to complete your zero-based budget before the month begins (if budgeting monthly), or before you get that next paycheck (if budgeting by paycheck).

If you’re just starting out budgeting, the idea of having to do it every month can seem daunting. I know.

But the truth is, every month is different.

You will have expenses that come up in some months that don’t come up in others.

For example, in October, you may want to budget for Halloween candy and costumes. In May, you may want to budget for Mother’s Day. You may include back-to-school expenses in your budget during the Fall, or birthdays and weddings, or registration for your son’s swim league in the months when those expenses are due.

That’s why one budget does not work for every month. To be successful at this, you must make a new zero-based budget each month.

But, don’t be freaked out! Just start with the first month. See how it goes. I promise once you start seeing the stress relief that a zero-based budget provides, you’ll never want to go back.

Ok, now that I’ve probably completely turned you away from budgeting altogether, let’s find out how to get started.

STEP ONE. Make a list of all of your monthly expenses. Start with your actual bills. These include things like rent/mortgage, utilities, internet, cell phone, car insurance, etc.

Then, add in all the other expenses you need to cover each month. These additional expenses aren’t bills per se, but are still things you need to cover each month like fuel for your vehicle and groceries. You can see a whole lot of potential budget categories, in my sample budget below.

Don’t try to allocate dollars to any categories yet. Just make a list of categories specific to your needs that you know you’ll need to budget for in the upcoming month.

Don’t forget to review your calendar for the upcoming month while you’re creating your list of categories. Are there any birthdays or anniversaries coming up? Any weddings? Any registration fees due for sports or other kids’ activities?

STEP TWO. Make a list of all your income. This includes pay from your regular job, but also any other income you may get throughout the month. Possible additional income categories include things like child support payments, freelance work, side hustle income, etc.

CAUTION: If your child support payments are few and far between, or irregular, don’t count on it when making your monthly budget. In an upcoming post, I’ll talk about how to budget on an irregular income. But you don’t want to count on money that isn’t reliable when planning your budget.

STEP THREE. Allocate all your monthly income across your budget categories. Start with your bills and most important expenses first. This includes mortgage/rent, utilities, and groceries. Keep assigning dollars to categories until every single dollar has been assigned to a budget category. When your budget categories equal your income, you’re done!

What if I don’t know how much to budget for a particular category?

No one can predict the future, I get it. So you aren’t going to know what your variable expenses are going to be, exactly. But you can get a rough idea by reviewing your past bank statements to get a feel for how much you should be budgeting. A good idea is to take your last 3 months of bank statements and review your expenses. That will give you a good feel for how much you regularly spend on say, groceries, utilities, and eating out.

On a go-forward basis, you should track your expenses, so you’ll get a better feel for how much you spend in any given category.

What if my expenses are higher than my income?

In this case, you have two choices: (1) Increase your income or (2) Decrease your expenses.

What if an unexpected expense arises and I didn’t budget for it?

I get this question a lot when I talk about zero-based budgets on Instagram. There are four options when this happens:

OPTION ONE - Use a Sinking Fund. Use a sinking fund! You know you are going to have certain expenses in certain categories. You may just not know when or how much. For example, you know your kid will get invited to a birthday party, your car will need a repair, and/or your pet will need a vet visit or flea medication. The question is when and how much?

So do yourself a favor and add those categories to your budget. These are called sinking funds, and I talk all about them in this post. So, add a car maintenance, pets, and/or birthdays category to your budget. And each month, add some money to those funds. When a need arises, simply take the money out of those funds without stress or worry!

OPTION TWO - Use a Buffer. Every zero-based budget I make includes a buffer or “cushion” category for unexpected expenses. I personally keep $120 on hand at all times for any unexpected expense. When an unexpected need arises, like my son has a field trip and needs $10, I can pull from the buffer without a crisis ensuing.

OPTION THREE - Adjust Your Budget. Another option is to rearrange your budget categories. Went over-budget on the groceries by $20? You’ll have to pull $20 from another category. This will happen A LOT when you start budgeting. That’s part of the process. It takes several months to get good at it. Don’t let that discourage you!

OPTION FOUR - Use Your Emergency Fund. I’ll go into greater detail in another blog post about your emergency fund, but for now, know that for TRUE EMERGENCIES, you can tap into your emergency fund to cover unexpected expenses.

Ok, so let’s get to it already! Below I show you an example of a zero-based budget for a woman who rents her home and brings home $4,000/month.

In this example, if you add up all budget categories, the total is $4,000.

The income ($4,000) - budgeted expenses ($4,000) = 0.

You’ll see some categories aren’t included: clothing, haircuts/beauty, vacation, to name a few. Remember each month is different. If those categories are a priority to you, then include them.

One category I include in every category budget is “Fun Money” and you can see it above. Fun money is money you just get to spend however you want. If you want to pick up a $5 Starbucks or go grab drinks after work, or treat yourself to a scented candle or new journal, or whatever you want to do, fun money is the category for you! Fun money helps you stick to your budget because it give you some wiggle room to still have some fun spending.

RELATED: Six Reasons You’re Failing at Budgeting.

I also include sinking funds in every budget I make, and you can see them in the example above.

You can also see with this budget, this woman is tithing on her income, paying minimums, and she still has $275 extra to throw at debt.

Remember, you don’t have to assign a dollar amount to every single category in my sample budget listed above. When you first start out, you may not have enough to put money in every single conceivable budget category ever thought of. That’s ok.

Allocate money to the important categories first: mortgage/rent, utilities, groceries, transportation, and debt.

You also don’t have to spend the amount you allocate to each category every month. If there’s money left in your electricity category at the end of the month, you can keep it and let it build up for the next month, or throw the extra to debt. Once you start getting good at budgeting, you’ll be better able to guess the proper amount to allocate to each category, reducing the chance there’s tons leftover, anyway.

And once you start using the debt snowball method to pay off debt, you’ll be able to free up income for other categories and/or to throw at your debt.

Before I started budgeting, I never knew exactly how much money I had to spend. Sure, I could check my bank account balance, and if it said $2,000, I thought I had plenty of money. But what if a $1,770 mortgage payment had to come out of that balance, or a $320 car payment, and a $200 electric bill, or worse, all three? Suddenly, that $2,000 bank balance isn’t looking so large and in charge. In fact, that $2,000 won’t even cover those 3 bills.

With a zero-based budget, though, you know exactly how much there is to spend in any category.

The mortgage is covered. The car payment is covered. The electric bill is covered.

If you want to eat out or have some fun, you can look at your budget categories and know exactly how much you have to spend, without digging yourself into a hole.

In a nutshell, the zero-based budget helps you spend with intention. How often are you guilty of mindlessly spending away your hard earned money? For many of us, it’s way too often. We do it so much, we don’t even recognize it. Can you tell me what % of your income you spent on debt last year? Eating out? Buying clothes? Utilities? When you spend with a plan, you’ll be able to. No one intends to go thousands of dollars into debt or spend money they don’t have. No sits down and says “I’m going to purposefully spend $600 more than I make this month!”

But, once you start budgeting your money—making a detailed plan for how you will spend every penny of that next paycheck (and the one after that and the one after that), you’ll start having success with money.

With a zero-based budget, you can begin to spend your money with purpose, to accomplish the financial goals you want in life. Our zero-based budget helped us pay off $68K in debt last year alone.

If you’ve never made a zero-based budget before, I encourage you to make one before the next month begins or before your next paycheck!

To make budgeting even easier, check out my Budget Worksheet for the Zero-Based Budget in the Shop. You can see the paycheck version below and the monthly version in the Shop.

If you have any questions about getting started, leave them in the comments below! And, if you want a peek into my real live budget I use in real life, head over to my Instagram page and check out my saved stories under Budgets.

If you enjoyed this post, be sure to share it on Pinterest, so your friends can see it too!

How to Complete a No-Spend Challenge (with free printable)

Five Sinking Funds Every Budget Needs

Five Tips for Saving on Car Repairs

Featured

Author: That Debt Free Life

Kate is a full time lawyer and part-time blogger from Texas who is 100% dedicated to personal finance education. By living her debt free journey as transparently as possible on social media, she hopes to inspire debt-free living for everyone. She loves talking about all things personal finance, finding creative ways to save money and increase income, and helping others reach their financial dreams. When she’s not lawyering, blogging, or mommin’ her sweet 7 year-old son, she can be found sleeping—because, seriously, is there time for anything else? Find her on Instagram or Pinterest.