Introduction

In the candlestick patterns dictionary, 37 candlestick patterns have been discussed in each post. These patterns have a high winning ratio because we have added proper confluences to each candle to increase the probability of winning in trading.

Here in this post, you will get a short explanation of each candlestick.

What are candlesticks?

A candlestick consists of three main points: closing price, opening price, and wicks. Candlestick indicates the direction of price, either bullish or bearish, showing information about price action.

- Open price: opening price indicates the first traded price of a specific pair exchanged during that time

- Close price: closing price indicates the last traded price of a specific pair exchanged during that time.

- Wick: wick indicates the variation in price relative to a specific pair’s opening and closing price.

Types of candlestick patterns

Candlesticks patterns are categorized into two major types based on the direction of the trend.

- Bullish candlesticks patterns

- Bearish candlesticks patterns

These two patterns are further classified into trend reversal, trend continuation, and ranging market patterns.

List of top 37 candlestick patterns

Here is the list of all the 37 high probability candlestick patterns.

| Candlestick Name | Forecast | Image |

|---|---|---|

| Pin bar candlestick | Buy/Sell |  |

| Engulfing candlestick | Buy/Sell |  |

| Inside bar candlestick | Buy/Sell |  |

| Morning doji star | Buy |  |

| Long legged doji | Buy/Sell |  |

| Three outside down | Sell |  |

| Bullish belt hold | Buy |  |

| Bullish piercing | Buy |  |

| Bearish belt hold | Sell |  |

| Rising window | Buy |  |

| Falling window | Sell |  |

| Tweezer top | Sell |  |

| Tweezer bottom | Buy |  |

| Dragonfly doji | Buy |  |

| Evening doji star | Sell |  |

| Rising three methods | Buy |  |

| Falling three methods | Sell |  |

| Bullish abandoned baby | Buy |  |

| Bearish abandoned baby | Sell |  |

| Bearish piercing | Sell |  |

| Three white soldiers | Buy |  |

| Three black crows | Sell |  |

| High wave | Buy/Sell |  |

| Three star in south | Buy |  |

| Deliberation | Sell |  |

| Bearish kicking | Sell |  |

| On neck candlestick | Sell |  |

| Upside Tasuki gap | Buy |  |

| Separating lines candlestick | Buy |  |

| Downside tasuki gap | Sell |  |

| Bearish breakaway | Sell |  |

| Bullish kicker | Buy |  |

| Bullish mat hold | Buy |  |

| Advance block | Sell |  |

| Matching high | Sell |  |

| Matching low candlestick | Buy |  |

| Tower bottom candlestick | Buy |  |

Pin bar

A pin bar candlestick is a trend reversal candlestick pattern that has a small body with a long tail on the upper or lower side. The color of candlestick does not matter in pin bar candles.

it is further divided into two types

- Bullish pin bar: The long tail will form below the body of candlestick

- Bearish pin bar: The long tail will form above the body of candlestick

Learn in detail

Engulfing

Engulfing candle refers to a candlestick that fully engulfs the previous candle. There are further two types of engulfing candles.

- Bullish engulfing

- Bearish engulfing

For better results in engulfing pattern, the body of the previous candlestick should be fully engulfed by the recent candlestick.

Learn in detail

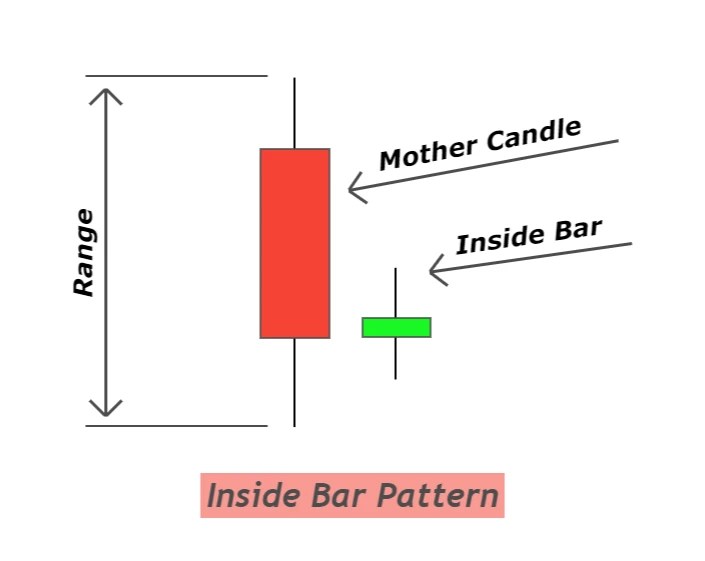

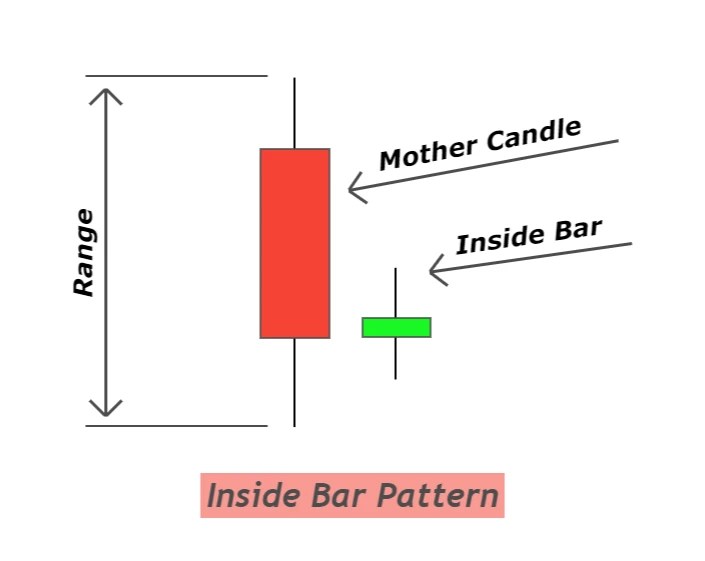

Inside bar

Inside barrefers to a candlestick pattern that consists of two candlesticks in which the most recent candlestick will form within the range of the previous candle.

It shows the indecision in the market. the market decides its direction by breaking the inside bar candle.

Learn in detail

Morning Doji Star

Morning Doji Star is a three candlestick pattern that consists of a bearish candlestick, a Doji candle, and a bullish candlestick in a series.This is abearish trendreversal candlestickpattern and a bullish candlestick.

it consists of three candlesticks and it will form at the bottom of the price chart.

Learn in detail

Long legged Doji

Long-legged Doji candlestick is a type of Doji candlestick that has a long lower and upper wick. All the Doji candlesticks have the same opening and closing price. The high and low make a difference between types of Doji.

Long-legged Doji represents indecision in the market.

Learn in detail

Three Outside Down

Three outside down is a bearish candlestick pattern that consists of three candlesticks in a specific pattern indicating abullish trendreversal.

Engulfing candlestick acts as an outside bar and then a small candlestick making a lower low confirms that bullish trend has been changed into abearish trend.

Learn in detail

Bullish belt hold

Bullishbelt holdis a candlestick pattern in which after three consecutive lower lows, a big bullish candlestick opens with agapmaking a new lower low and then closing within the range of the previous candlestick.

it is a trend reversal candlestick pattern.

Learn in detail

Bullish Piercing

The bullish piercing pattern is abullish trendreversal candlestickpattern that consists of two candlesticks and the recent candlestick closes above the 50% level of the previous candlestick.

A piercing pattern is a simple candlestick pattern that also resembles a bullishpin baron a higher timeframe.

Learn in detail

Bearish Belt Hold

Bearish belt hold is a trend reversal candlestick pattern that changes bullish price trend into the bearish price trend. After the formation of three bullish candlesticks, a long bearish candlestick forms at the top of the price chart resulting in a price trend reversal.

it is the opposite pattern to the bullish belt hold.

Learn in detail

Rising Window

The rising window is a candlestick pattern that consists of two bullish candlesticks with agapbetween them. The gap is a space between the high and low of two candlesticks. it occurs due to high trading volatility.

It is a trend continuation pattern

Learn in detail

Falling Window

The falling window is a candlestick pattern that consists of two bearish candlesticks with a down gap between them.The down gap is a space between the high of the recent candlestick and the low of the previous candlestick.

it is a bearish continuation pattern.

Learn in detail

Tweezer top

The tweezer top is a reversal candlestick pattern that consists of two opposite color candlesticks and the closing price of the first candlestick will be equal to the opening price of the second candlestick.

It is a reversal pattern that changes the price trend frombullishinto bearish.

Learn in detail

Tweezer Bottom

The tweezer bottom is areversal candlestickpattern that consists oftwo opposite color candlesticks and theclosing price of the first bearish candlestick will be equal to the opening price of the second bullish candlestick.

It is a bullish reversal candlestick pattern

Learn in detail

Dragonfly Doji

Dragonfly Doji is a type of Doji candlestick that represents indecision in the market, and it turns the bearish price trend into abullish trend.

The large wick size indicates the false breakout that results in a trend reversal.

Learn in detail

Evening Doji Star

Evening Doji Star is a three-candlestick pattern made up of a bullish candlestick, a Doji candle, and a bearish candlestick in series. It is abullish trendreversal candlestickpattern.

Learn in detail

Rising Three Methods

Rising three methods is a trendcontinuation candlestickpattern that consists of five candlesticks on the price chart. It forms during trending market conditions and indicates that price will continue.

Rising three methods candlestick pattern helps a trader make critical trade management decisions like either holding a specific trade or closing that trade instantly.

Learn in detail

Falling Three Method

Falling three methods is a trend continuation bearish candlestick pattern that consists of five candlesticks. It represents that the previousbearish trendwill continue, decreasing the price.

It is not atrend reversalcandlestick pattern.

Learn in detail

Bullish Abandoned Baby

A bullish abandoned baby is a trend reversal candlestick pattern that consists of a bullish candlestick, a Doji with a gap down, and a bearish candlestick.

This candlestick pattern rarely forms on the price chart. Usually, you will see this pattern in the price chart of stocks and indices.

Learn in detail

Bearish Abandoned Baby

A bearish abandoned baby is a trend reversal candlestick pattern made up of a bearish candlestick, a bullish candlestick, and a Doji.Agapforms before and after the Doji candlestick, and Doji candlestick forms between bearish and bullish candlestick.

More than one Doji candlesticks in anabandoned babypattern can also form between bullish and bearish candlestick.

Learn in detail

Bearish Piercing

The bearishpiercing patternis abearish trendreversal candlestickpattern that consists of two opposite color candlesticks with a pricegapin between them. In this pattern, the bearish candlestick will close below the 50% level of the previous bullish candlestick.

Learn in detail

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

Get Access to Course

Three White Soldiers

Three white soldiers is abullish trendreversal candlestickpattern that consists of three bullish candlesticks making higher highs and high lows. These candlesticks form in series with small wicks and shadows representing a massive momentum of sellers.

Thethree black crowscandlestick pattern is opposite to the three white soldiers’ pattern.

Learn in detail

Three Black Crows

Three black crows is abearish trendreversal candlestickpattern that consists of three big bearish candlesticks making lower lows and lower highs.

Three black crows candlestick patterns should form at the top of the price uptrend to get a high winning rate.

Learn in detail

High Wave

The High wave pattern is a candlestick pattern with large wicks/shadows than the average size of candlestick. The body of the candlestick is tiny as compared to the shadows.

It is like a spinning top orlong-legged Dojicandlestick.

Learn in detail

Three Stars in the South

The Three Stars in the south is a bullishreversal candlestickpattern made up of three bearish candlesticks. In this candlestick pattern, each candlestick forms within the range of the previous candlestick.

The structure of this pattern also relates to theinside bar candlestick pattern,

Learn in detail

Deliberation

Deliberation Candlestick pattern is atrend reversalcandlestick pattern made of three consecutive bullish candlesticks in a proper sequence.This candlestick pattern is also known as stalled candlestick pattern.

Learn in detail

Bearish Kicking

Bearish kicking is a price trend reversal candlestick pattern consisting of two opposite-colored marubozu candlesticks with a gap between them.It will mostly form at the top of the price chart or Resistance/supply level.

The bearish kicking candle is used to forecast an upcomingbearish trendin the market.

Learn in detail

On Neck

The On-neck pattern is a candlestick pattern in which after a long bearish candlestick, a small candlestick will with agapdown, and it will close near the opening price of the previous big bearish candlestick.

It is abearish trendcontinuation candlestickpattern

Learn in detail

Upside Tasuki Gap

The upside Tasukigapis abullish trendcontinuation pattern that consists of three candlesticks and an upside gap.

This candlestick pattern tells retail traders that the market’s bullish trend will continue, and buyers are in control.

Learn in detail

Separating Lines

The separating lines candlestick is a trend continuation pattern consisting of two opposite-colored candlesticks. The closing of the first candlestick will be equal to the opening price of the second candlestick.

It indicates that the previous trend will continue.

Learn in detail

Downside Tasuki Gap

The Downside Tasukigapis acontinuation candlestickpattern that consists of three candlesticks with a downside gap. The downside gap will form within two bearish candlesticks.

It is abearish trendcontinuation pattern representing the seller is in control.

Learn in detail

Bearish Breakaway

Bearish breakaway is a bearish reversal candlestick pattern that consists of five candlesticksand a gap zone. After forming this candlestick pattern, abullish trendwill turn into a bearish price trend.

Learn in detail

Bullish Kicker

Bullish kicker candlestick is a bullish trend reversal candlestick pattern consisting of two opposite-colored candlesticks with a gap between them.It will turn thebearish trendinto a bullish price trend.

Learn in detail

Bullish mat hold

Bullish mat hold is a trendcontinuation candlestickpattern consisting of five candles and agap. It shows that the previous trend will continue.

Bullish mat hold pattern primarily forms in stocks and indices.

Learn in detail

Advance Block

The advance block is a bearishreversal candlestickpattern that consists of three bullish candlesticks. It will turn the bullish price trend into abearish trend. That’s why it will form at the top of the uptrend.

It is a single pattern that does not have an opposite pattern (bullish reversal) due to rare occurrences on the price chart.

Learn in detail

Matching High

Matching high is a bearish reversal candlestick pattern consisting of two bullish candlesticks with the same high and no shadows on the upper side.

The second candlestick opens with agapdown in this pattern.

Learn in detail

Matching Low

Matching low is a bullish trend reversal candlestick pattern that consists of two bearish candlesticks with the same closing price and no shadows on the lower side of candlesticks.

Learn in detail

Tower Bottom

Tower bottom is a bullish trend reversal candlestick pattern of two opposite-color big candlesticks and three to five small base candlesticks.

Learn in detail

Conclusion

The candlestick patterns are widely used by retail traders in technical analysis. These patterns were introduced by steve nison.

I will highly recommend using these candlestick patterns as a confluence with other technical tools for profitable results.

Remember to backtest a single pattern at least 50 times to become a Pro trader.